Portfolio Jan 2024 Report and Feb 2024 Strategy

Preparing for CNY thus the late report

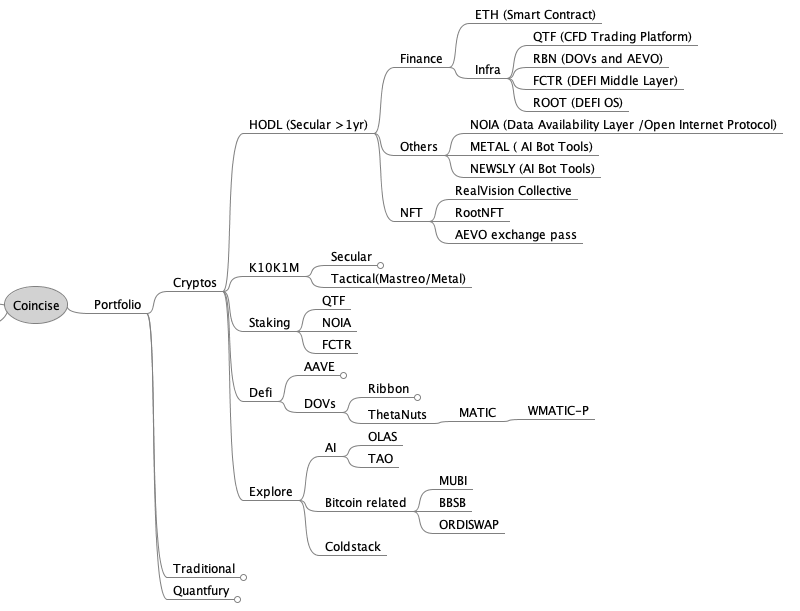

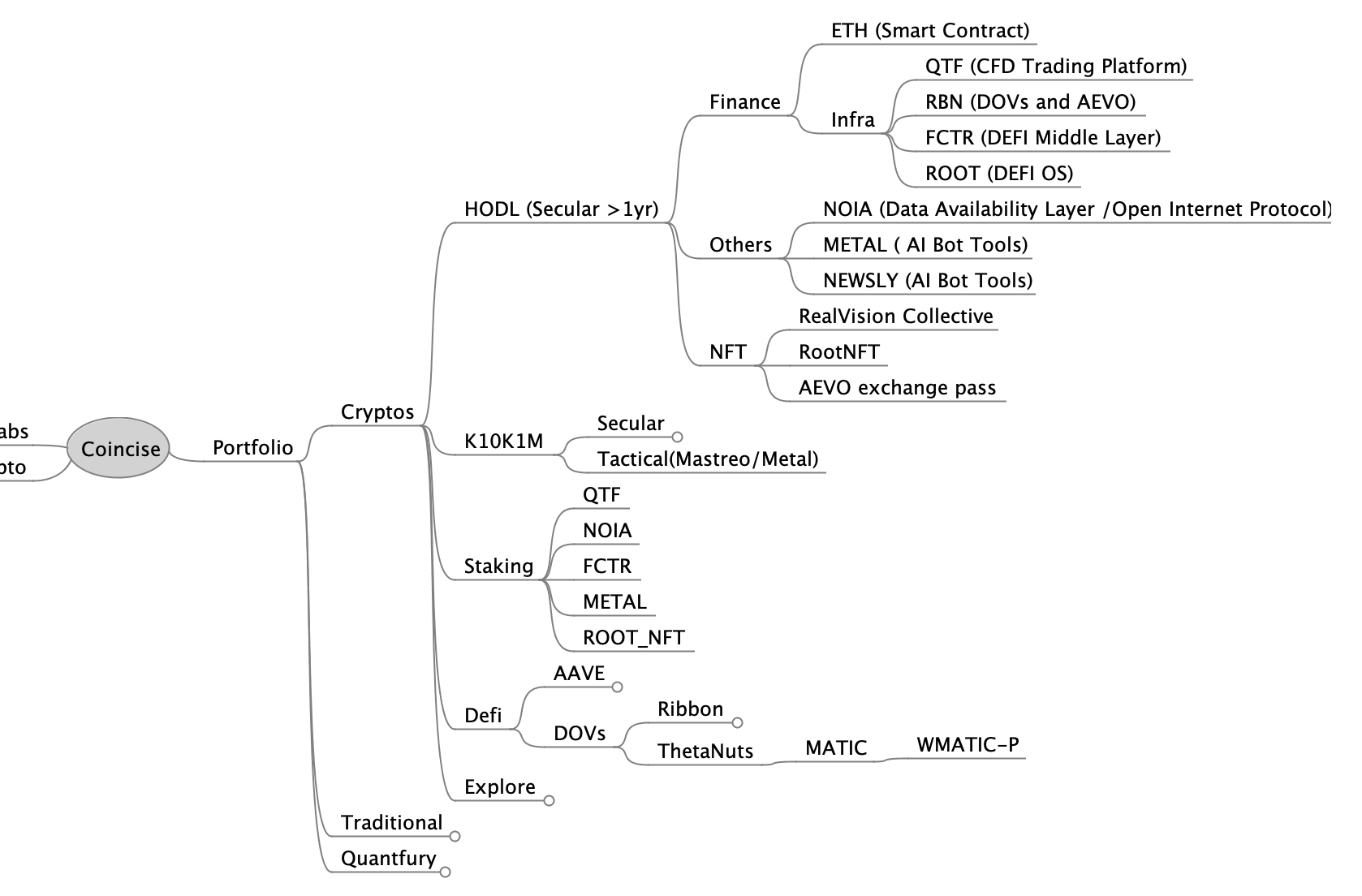

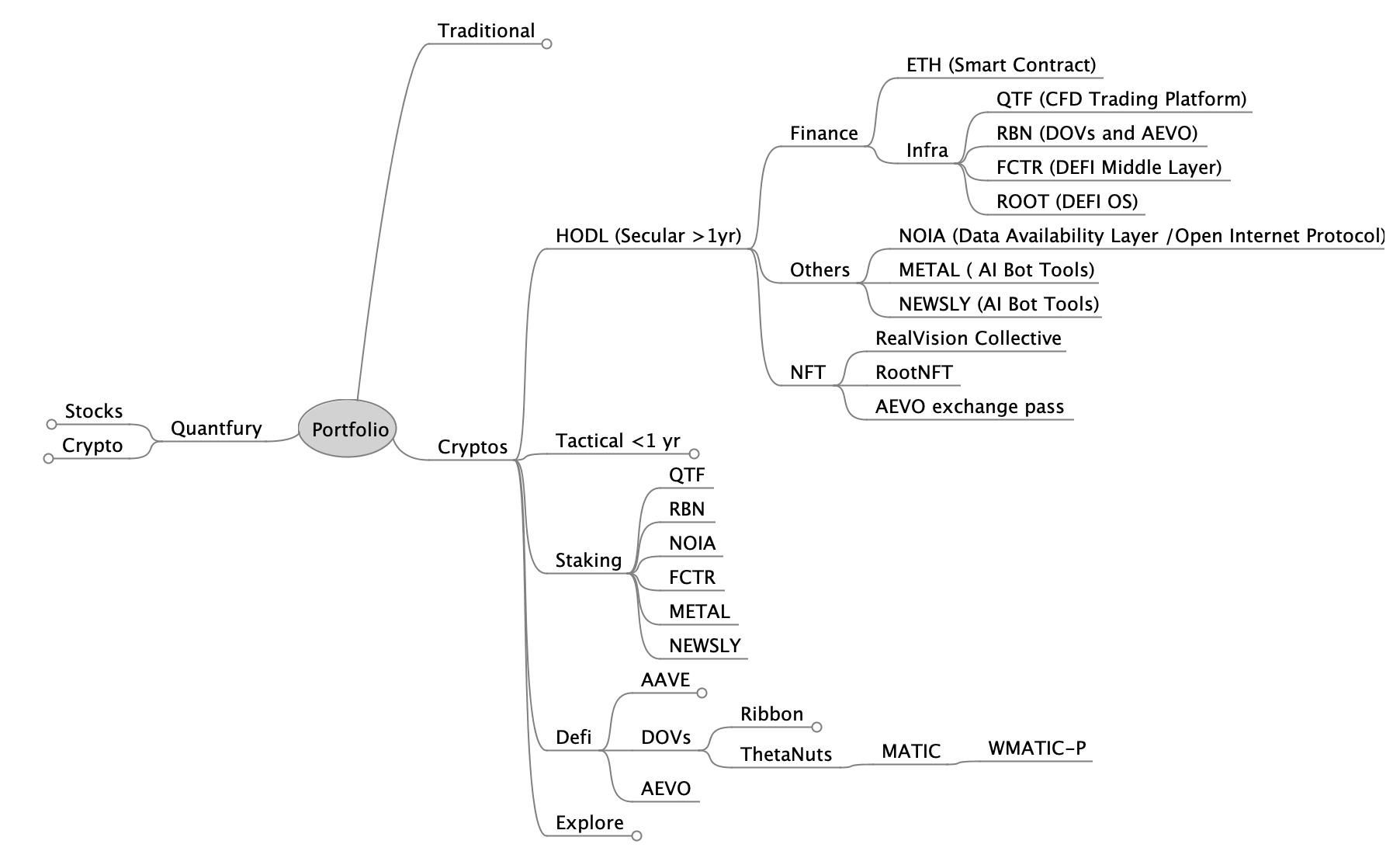

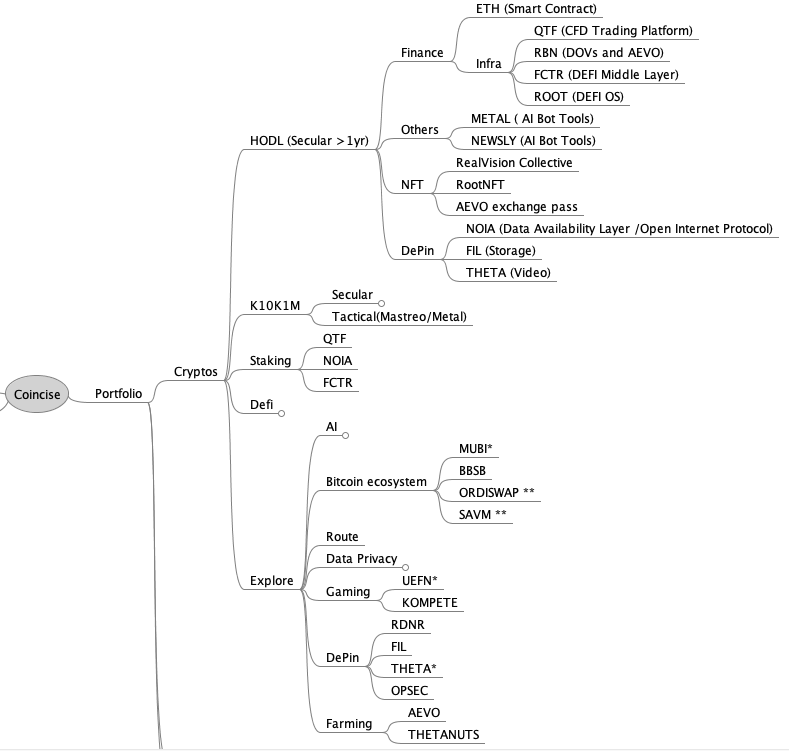

Finance

QTF price remains stable at 6insh.

RBN price rises and remains stable at 0.4-0.5 insh, AEVO token and farming program will be announced soon exicting times ahead

Eth, nothing more to add but just keep adding

no news for lychee protocol, just need to wait

K10K1M remains stable, averaging 20% in CAGR since last sep 2023

Metaverse + Infra

Syntrophy is now in silverstone, so mainnet, and the support level is around 0.08-0.10 insh

Explore

Looking at MUBI and Ordiswap, and increase more tokens in NOIA at support levels

Need to farm for thetanuts token.

DEFI

same as last month, using chainedge and also metal.tools to find alpha

NFT

Hodl on to my realvision, AEVO and ROOT Nfts

Returns and Recurring Income

Has been stable

STOCKS

Bull market for Cryptos!

OCT Strategy

Stacked more NOIA, RBN, ETH when and where possible.