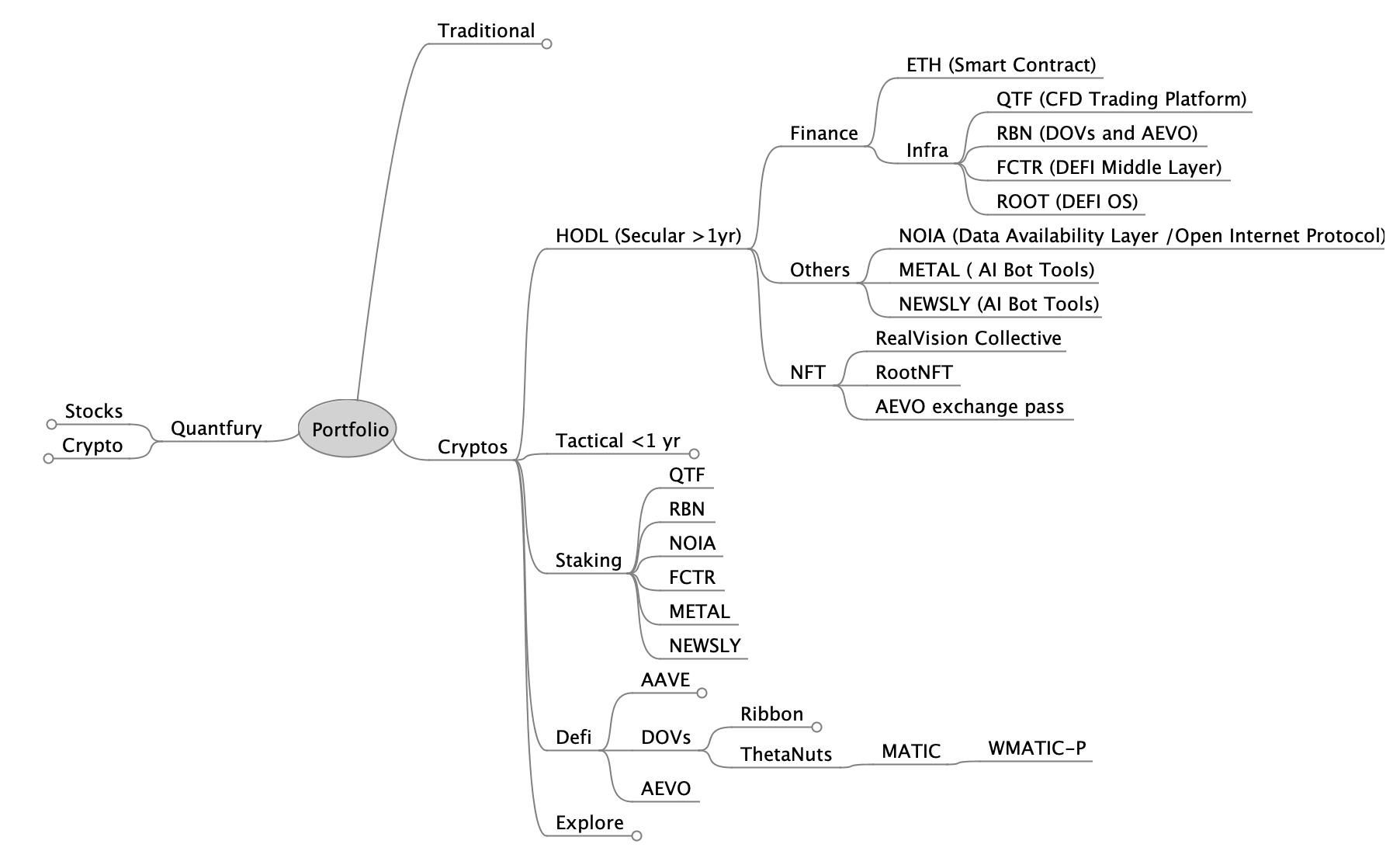

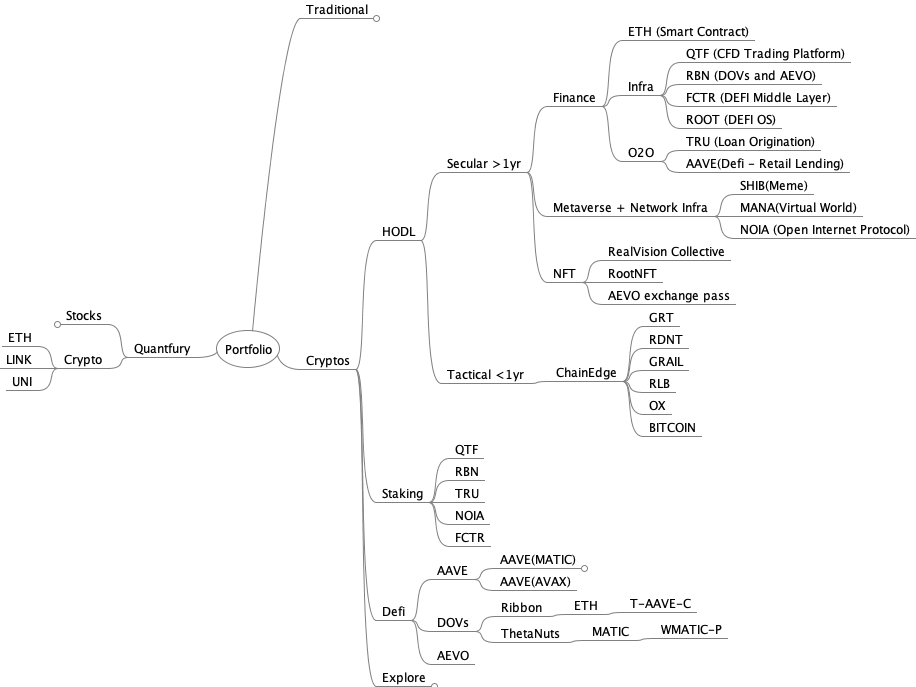

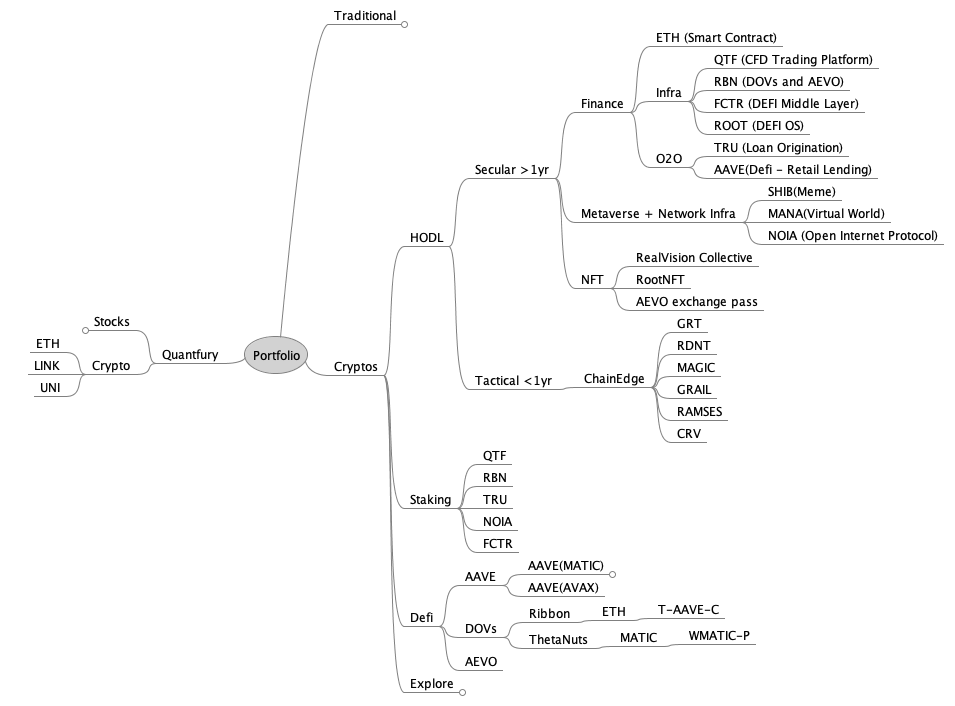

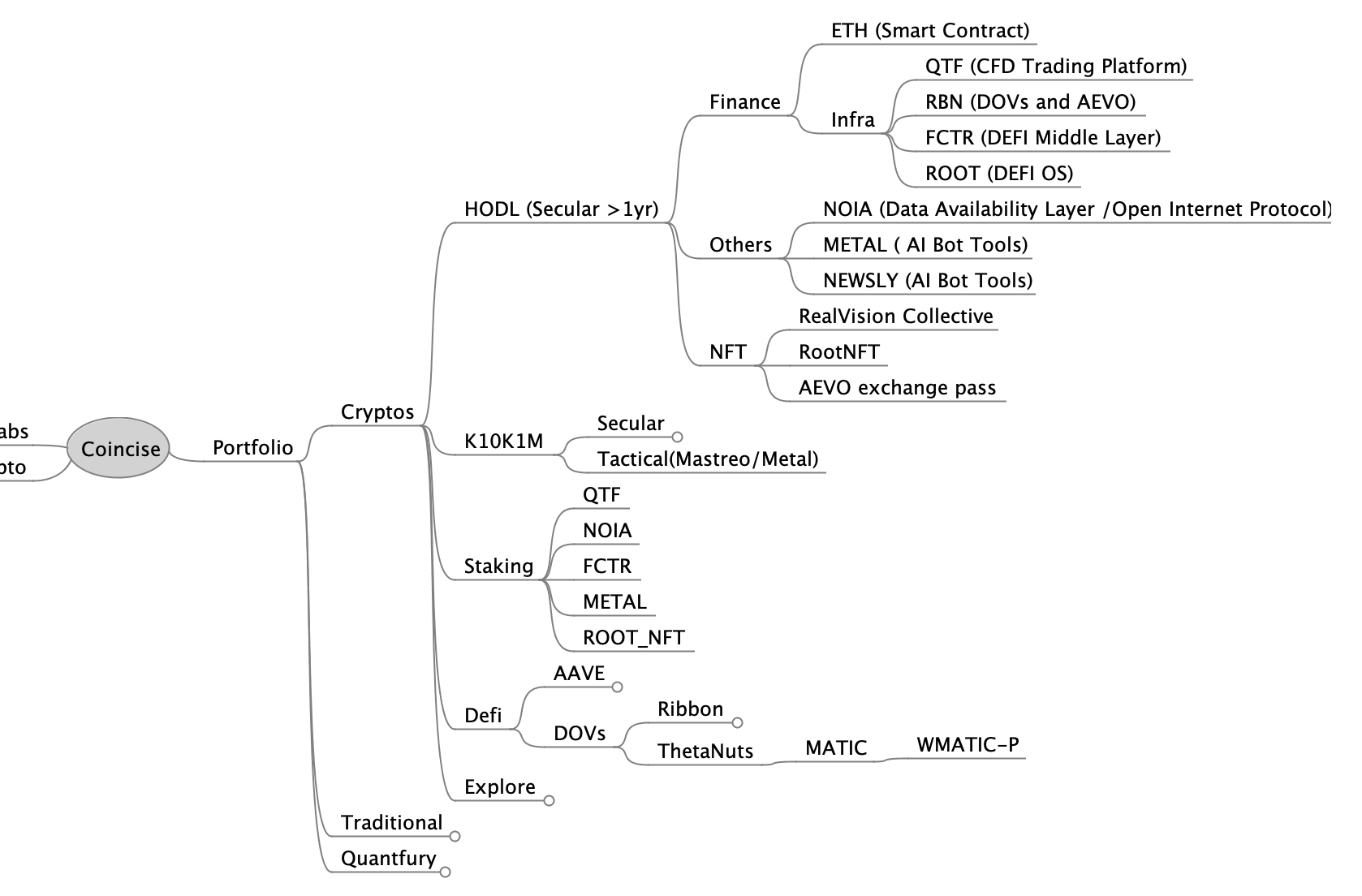

Portfolio OCT/NOV 2023 Report and DEC 2023 Strategy

my old changes were lost for oct and nov as i migrated over to this new website setup, forgotton to backup but oct and nov changes are the same.

Finance

QTF price move up to 6insh, hope the wealth wallet will lanuch soon.

RBN price went back up to 0.30insh, they will move to a new token AEVO and some whales are buying in the chainedge platform, they have grown quite fast and have a dedicated metrics page -> https://aevo.metabaseapp.com/public/dashboard/81ee5b91-fbd2-41a5-90dd-d22771425f26

Eth, nothing more to add but just keep adding

did sold off half of TRU but keeping at the moment, created a new portfolio which will concentrate of secular and tactical aspects of it, will reveal more in year end once some assets are shifted over.

ROOT has relanuched as lychee protocol due to being sued for the same brand root.

Metaverse + Infra

Syntrophy did announced a new whitepaper but not much into tokenomics and will have mainnet launched in Q1 2024, price have been inching up slowly, in the class of graph, and chainlink. Needs more adoption and marketing

Explore

DEFI

same as last month, using chainedge and also metal.tools to find alpha

NFT

Hodl on to my realvision, AEVO and ROOT Nfts

Returns and Recurring Income

Has been stable

STOCKS

have stopped as the narrative has changed in prepartion of the bull market next year for crypto

OCT Strategy

Stacked more NOIA, RBN, ETH when and where possible.