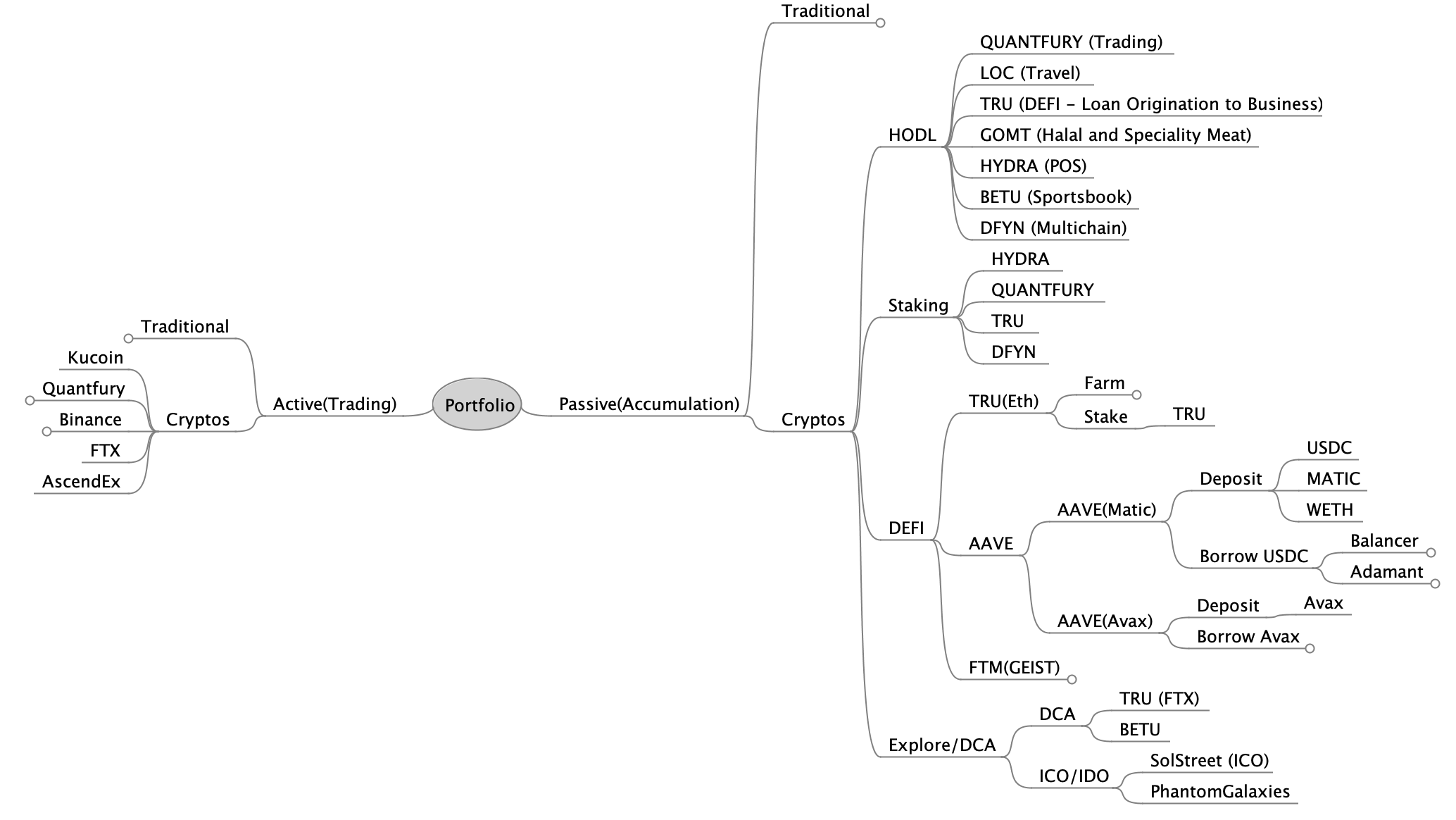

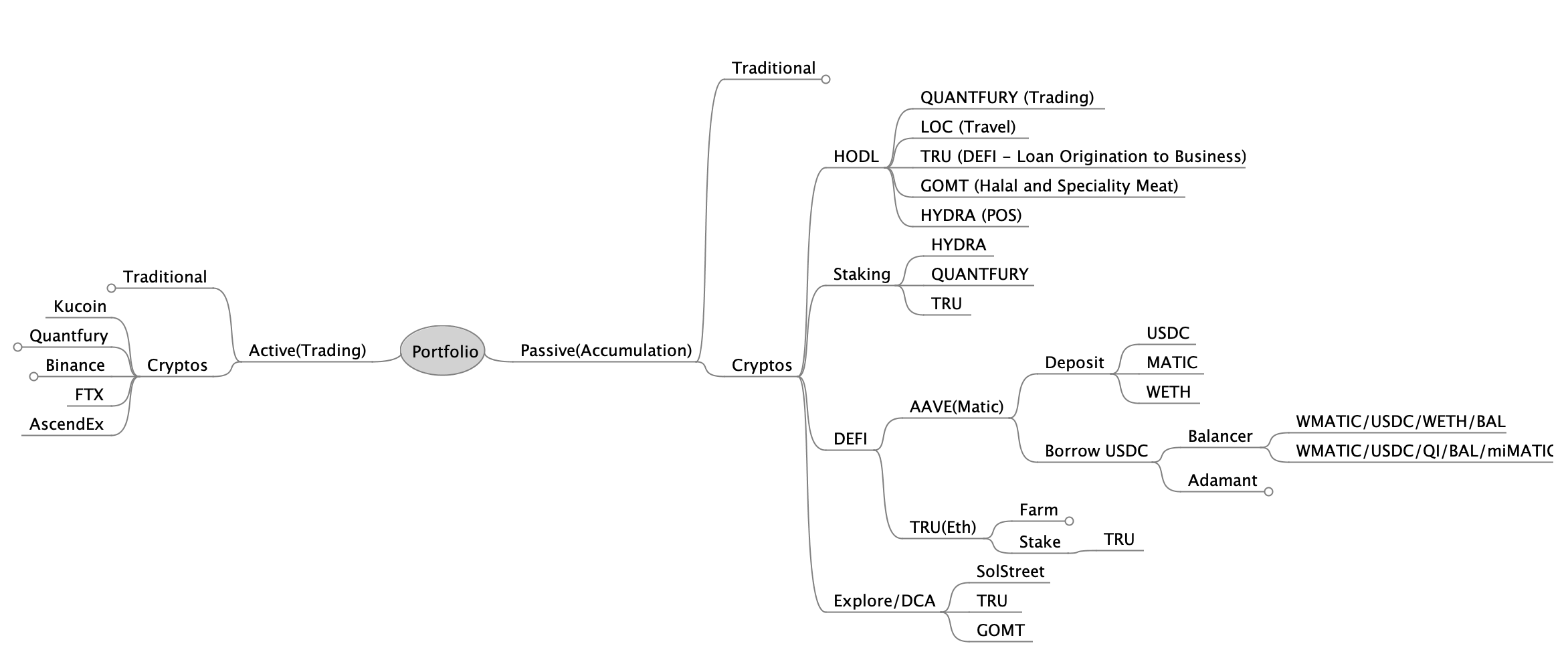

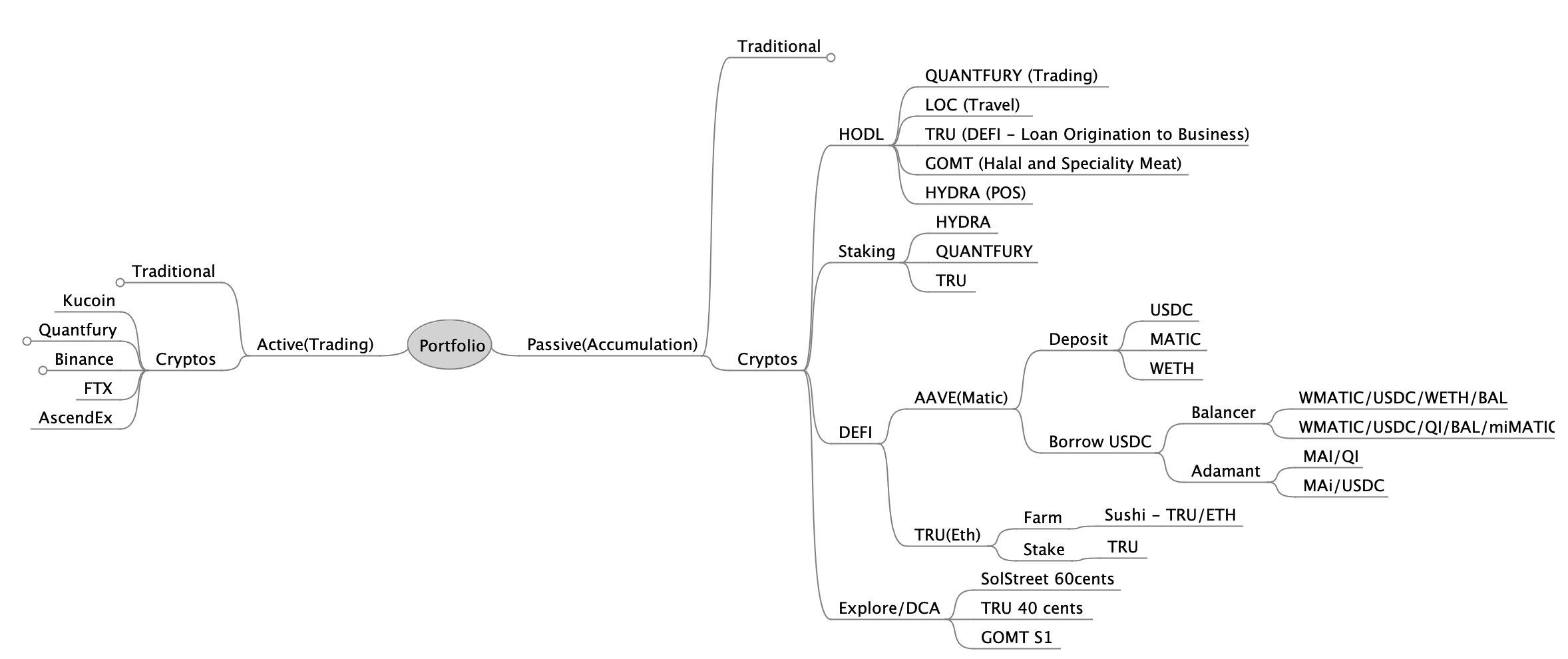

Portfolio Nov 2021 Report and Dec Strategy

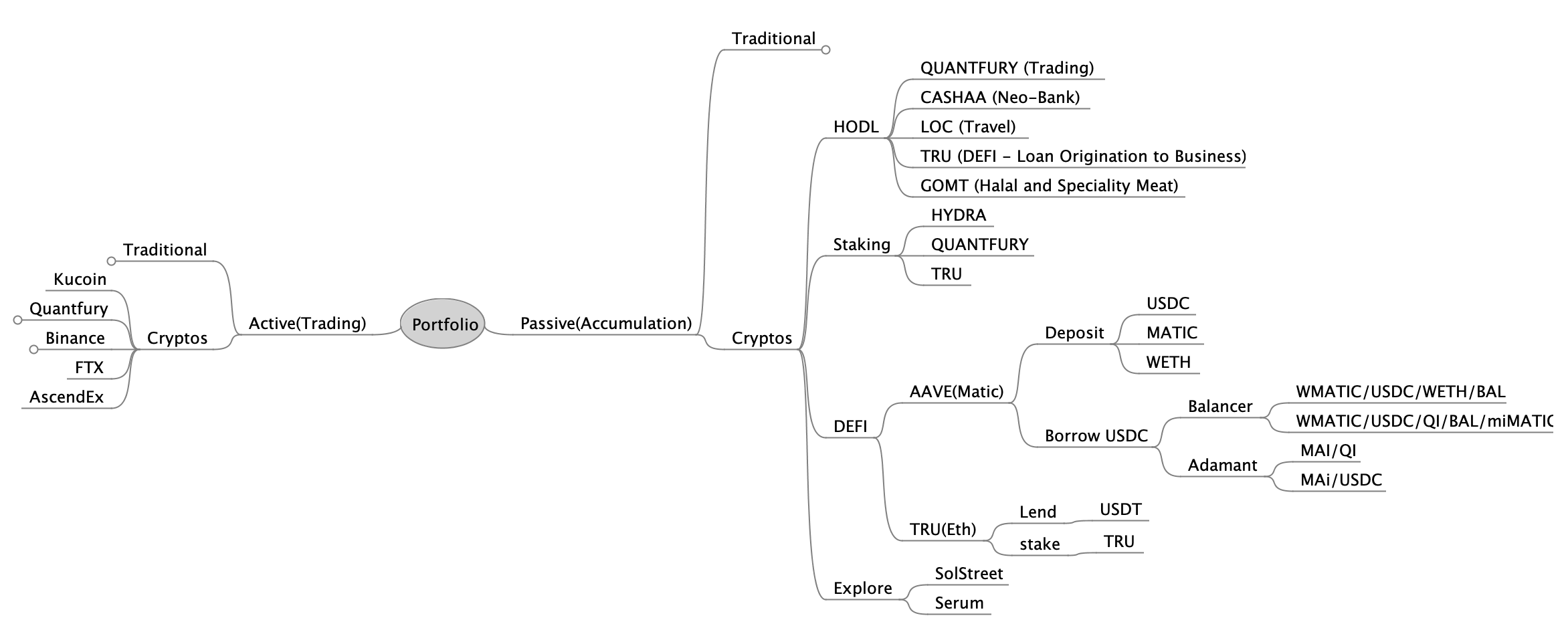

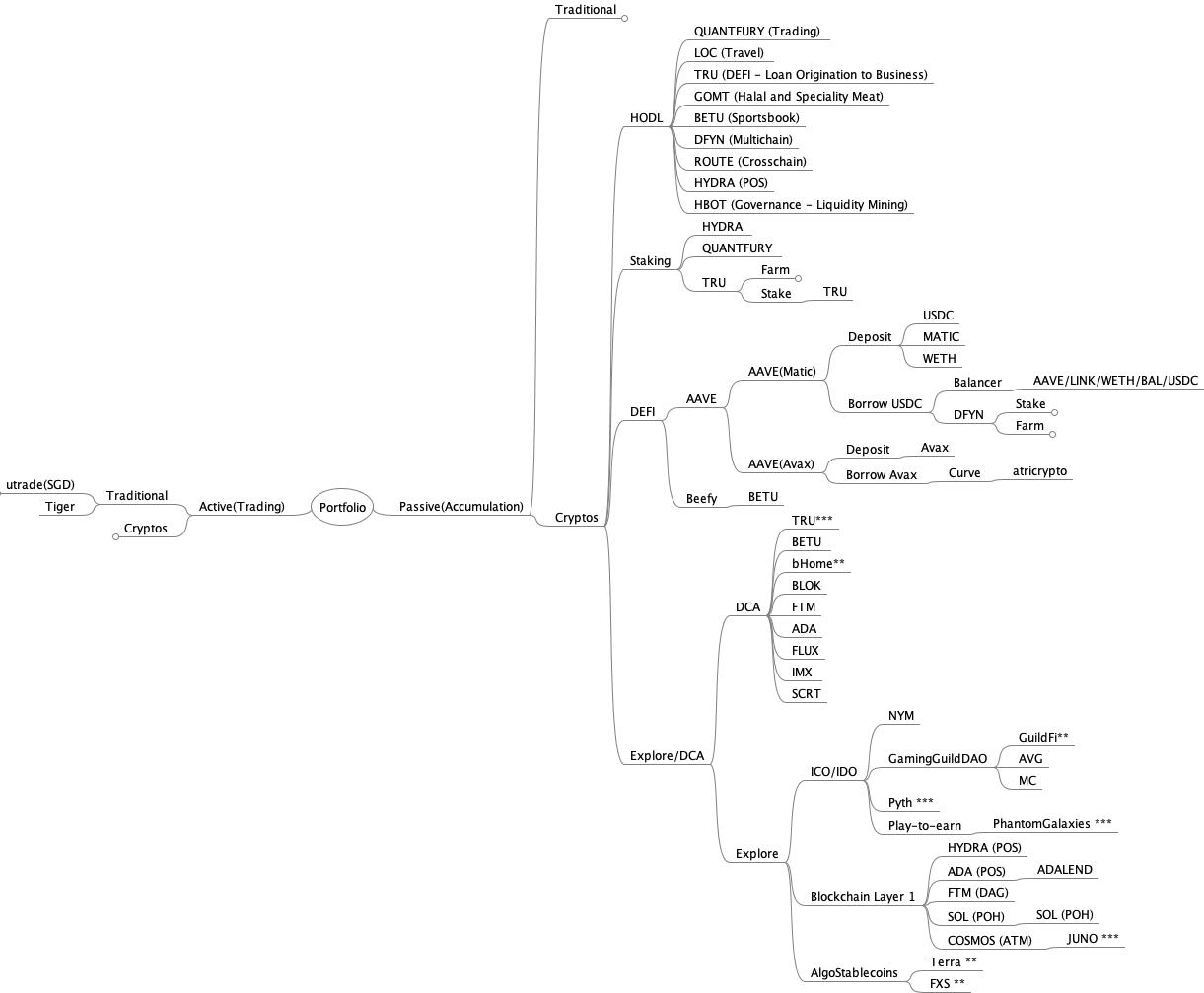

Nov portfolio as follows:

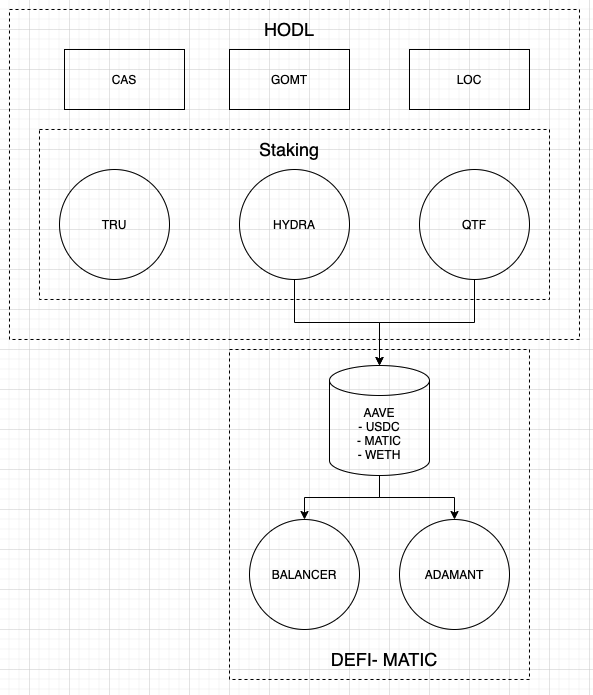

HODL

GOMT has listed their coin on Hydra Dex and will list the token on a tier 2 exchange which will be announced in December. Was hoping for Kucoin though. The price fluctuates 0.99 to 1.87 in Nov and reach 3000 GOMT burnt. For more details on their progress -> https://gomeattoken.medium.com/?p=9d212dfd30d6

TRU value in increasing in a 30-45 degree upslope, very slow but surely. Will continue to accumulate more for once the chance arises.

QTF value has spike up to $28ish but drop back down to 18.

LOC price has been stable.

HYDRA still getting their airdrop every week till they stopped for two weeks due to community vote, see https://medium.com/locktrip/hydras-super-dao-economic-patch-and-much-more-community-vote-bundle-e2f78476f2c8 They have since resume but price has been dropping.

BetU, have started to play in their fantasy league where you participate by locking 1000 BETU tokens to get 1000 fantasy pts per league. The rewards are in BETU tokens, and you don't lose any BETU tokens. Pretty fun.

DFYN and ROUTER are the same company, have stake DFYN and farming DFYN/ROUTE. They have just finished audit with Hailborn and asking folks to test their testnet.

Explore

Found Baconcoin, ZKSync and DFL, going to explore more of them...

Staking

Added DFYN.

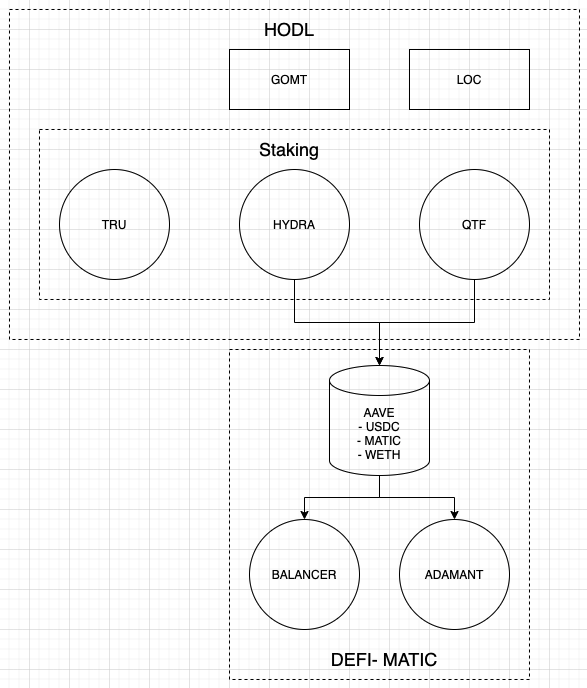

DEFI

Still going hyper-compound Matic, invest in Balancer pool, still hoping to see matic triple in value in dec so i can return the loan. Going to test out Beefy finance

Dec Strategy

Stacked more TRU, BETU, DFYN, MATIC, BETU, bhome when possible.

Will continue to trade FTX futures.