Portfolio Nov Report

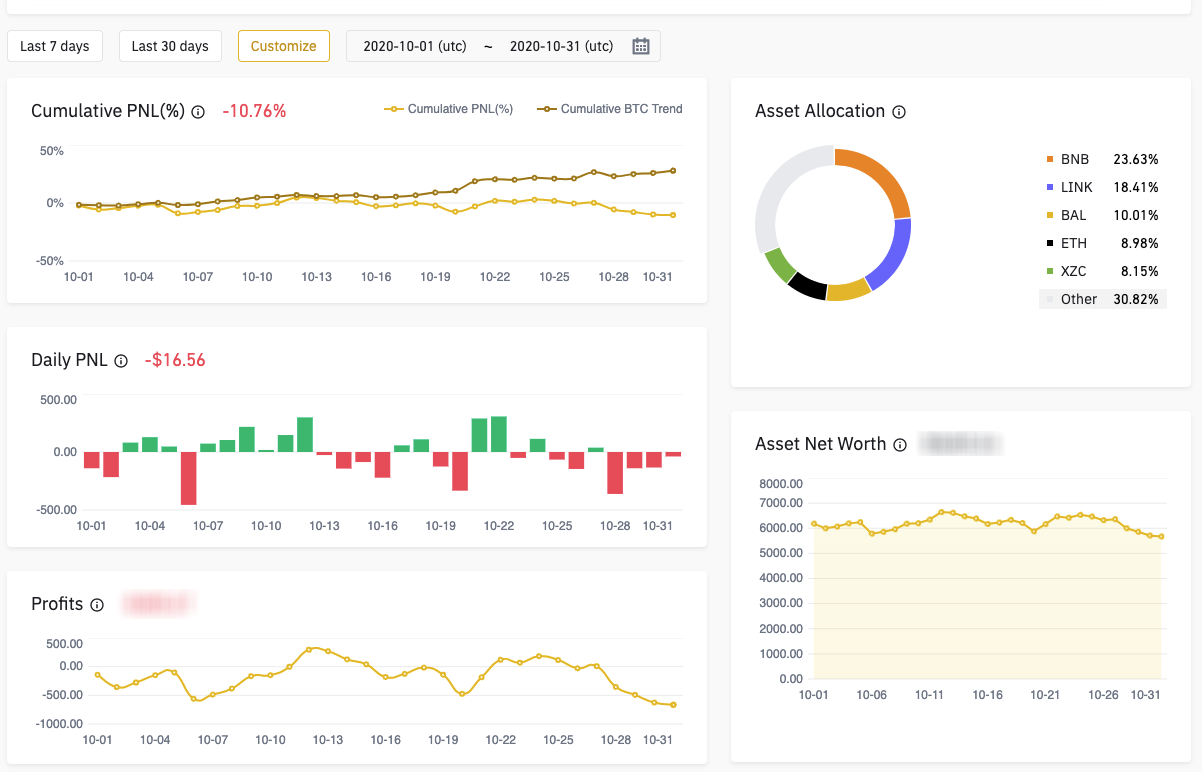

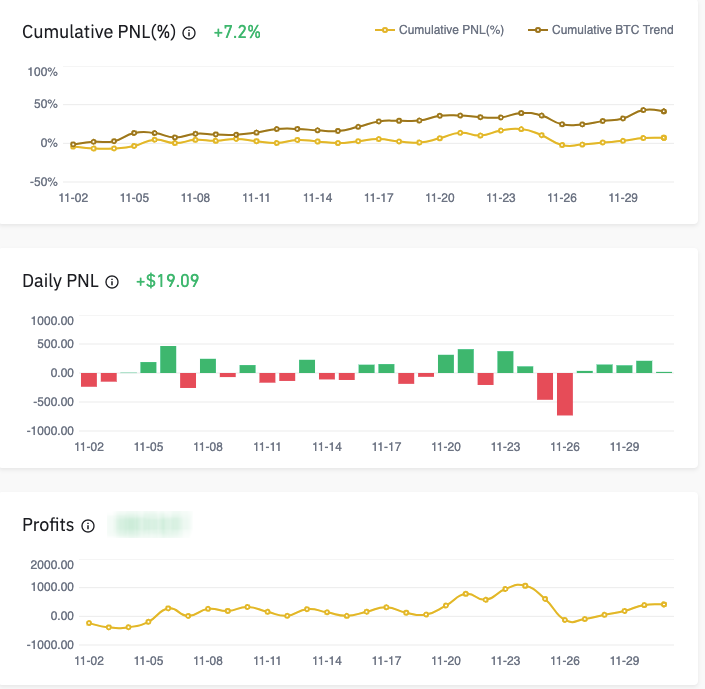

Nov was a bit better due to BTC mooning and ETH2.0 staking but overall the portfolio is down because the majority of coins are altcoins and BTC climb up a lot. Still have the same coins:

Store of value coins (treated like bonds):

- BTC

- ETH

- USDT

- BNB

Alternative coins(treated like stocks):

- BNT

- LINK

- BAL

- RLC - Mining rewards

- NEM - Mining rewards

- RLC - Mining rewards

- HARD - Mining rewards

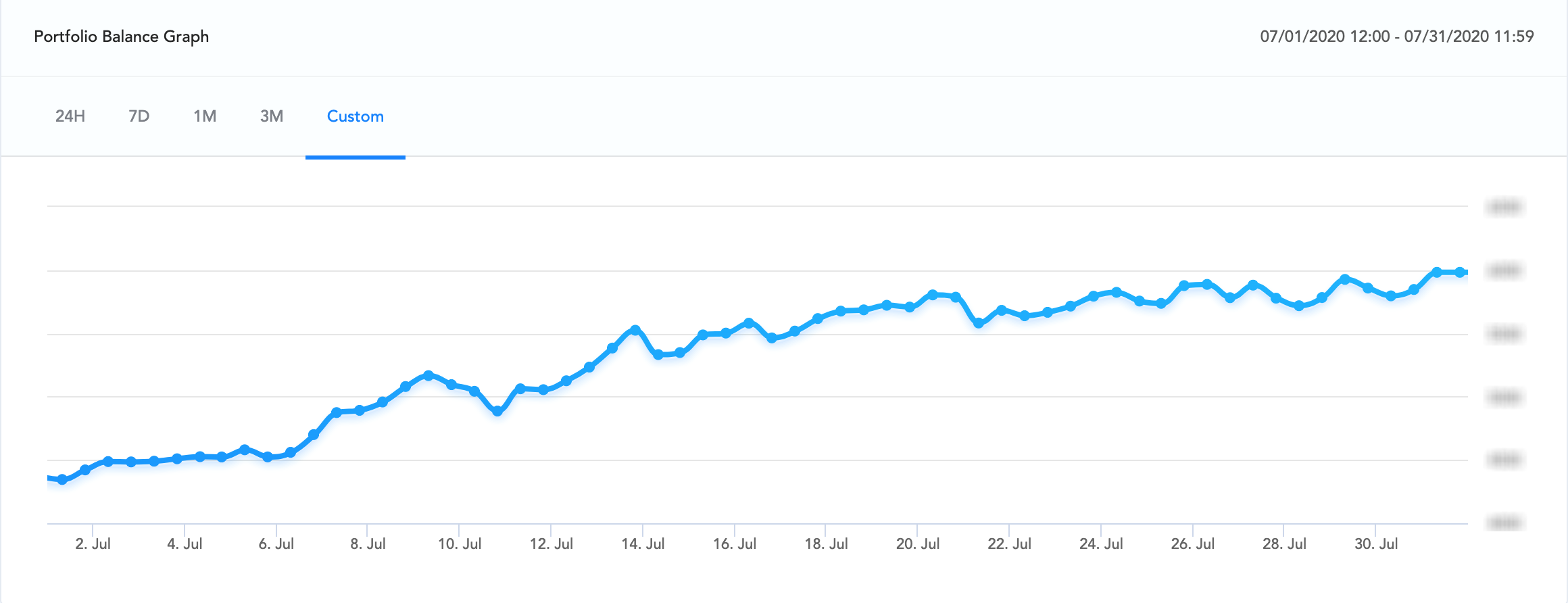

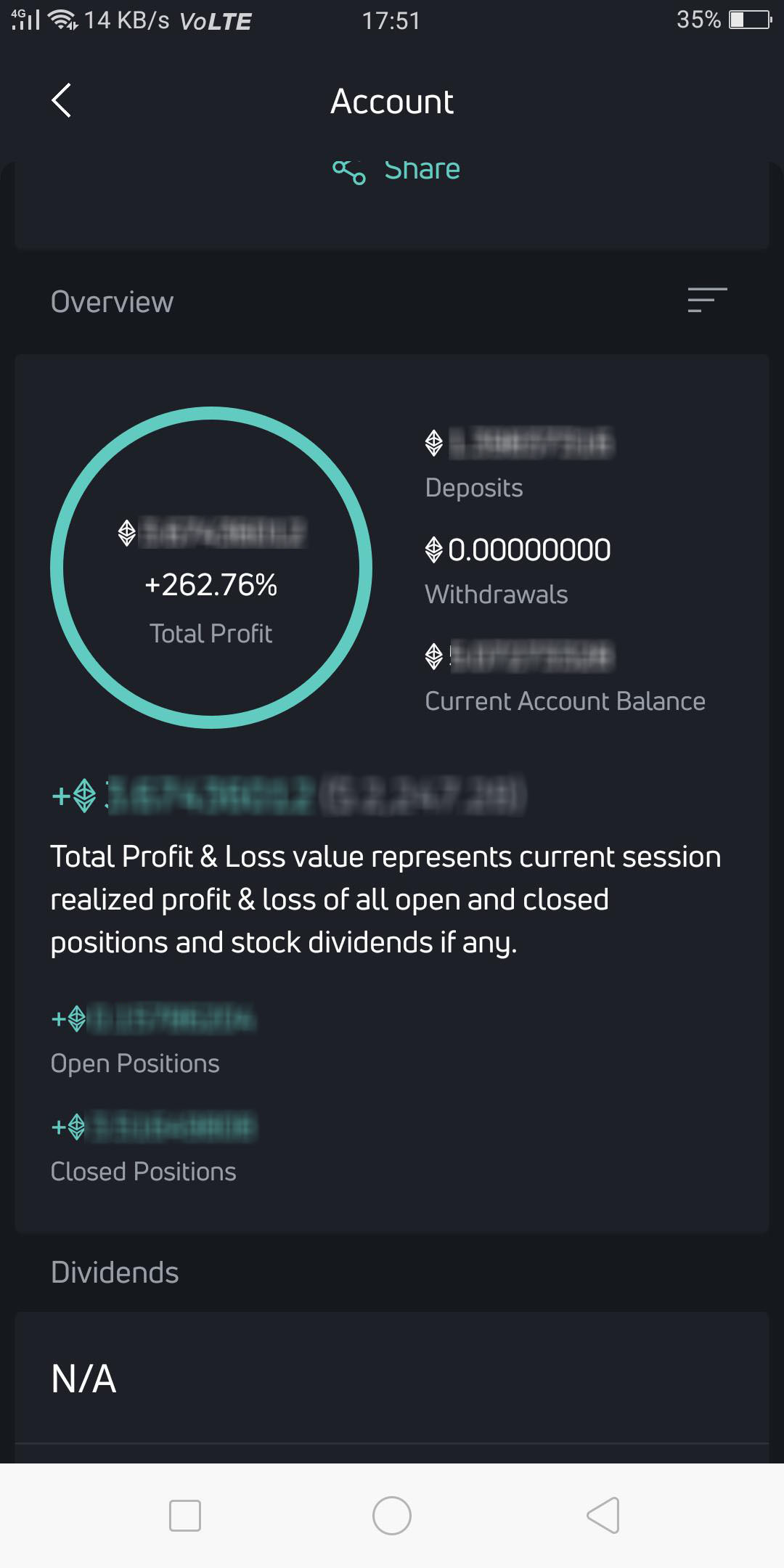

Have restarted to use Quantfury since October this year to follow systematic trading of using pivot levels, the results have been pretty ok, see screenshot. Been using much lower leverage up to a maximum of 3. so 1:3.

Have upgraded my tradingview to premium to have more server-side alerts and test 3commas again. Hopefully, will have positive results.