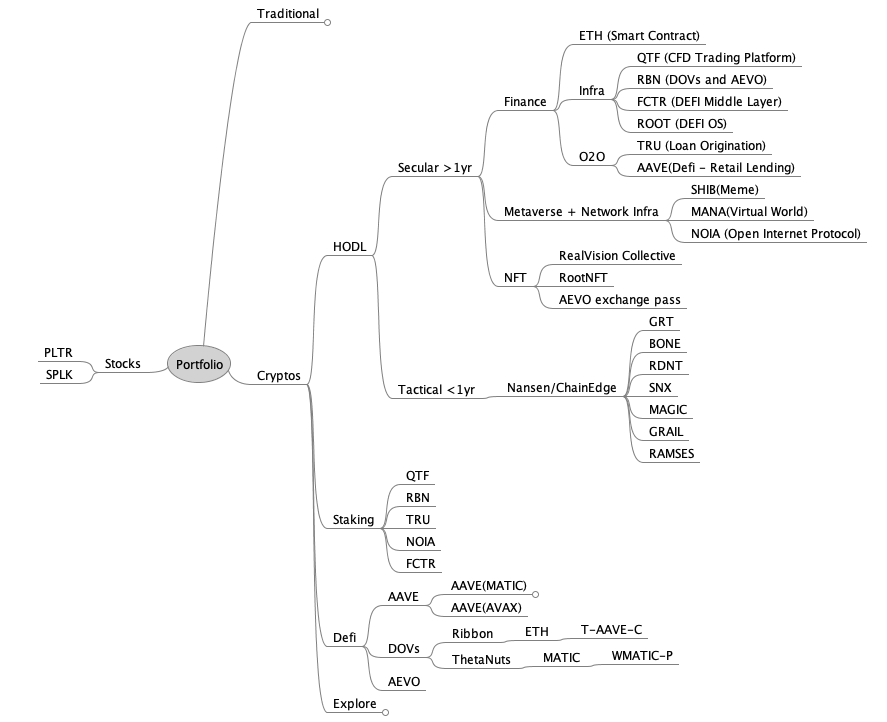

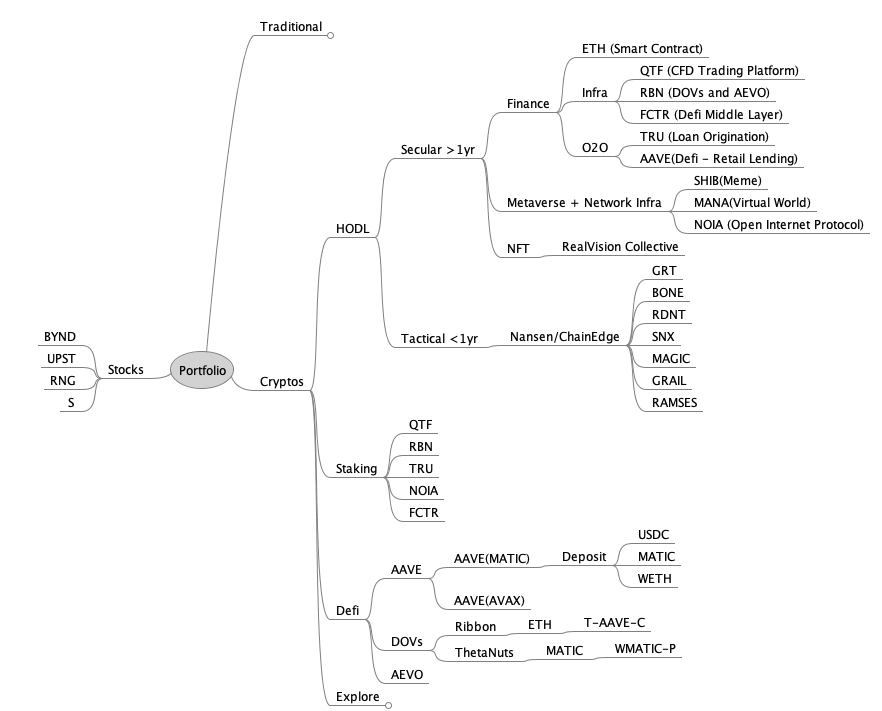

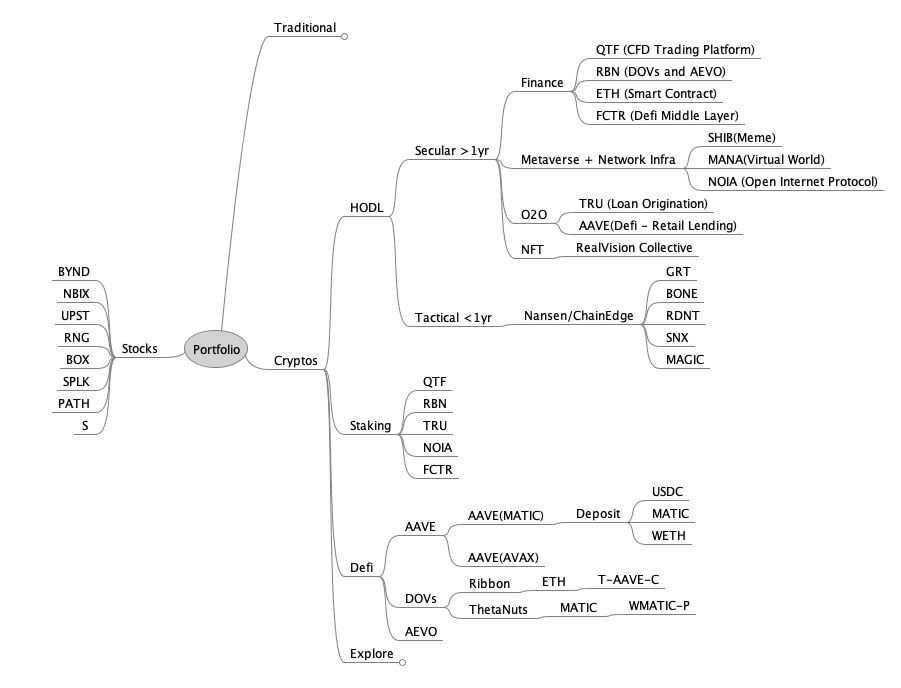

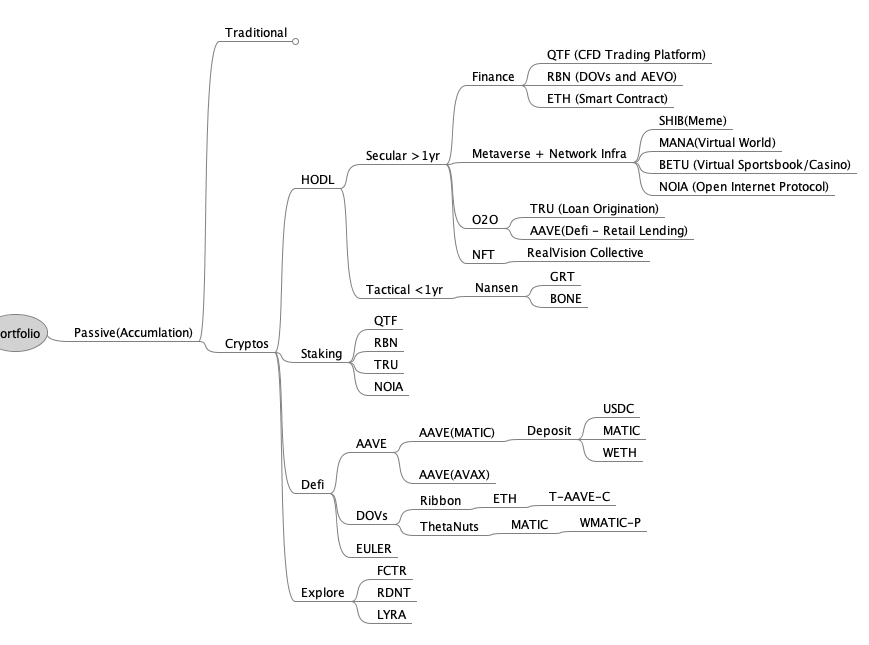

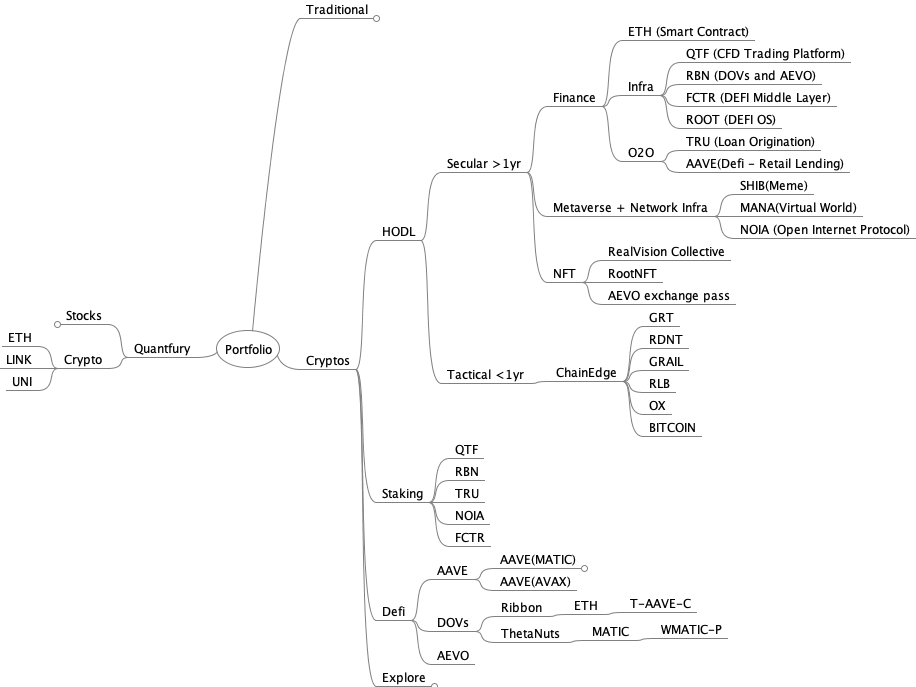

Portfolio JUNE 2023 Report and JULY 2023 Strategy

Finance

QTF price drops to 8 insh, still waiting for the wealth management wallet to be launched.

RBN price moves towards 0.17-0.18 ish and TVL is moving up to 4 million Source - https://defillama.com/protocol/aevo . Team is still shipping products, hopefully the tokenomics will be out soon in this quater.

Eth, nothing more to add but just keep adding

FCTR price dropped to 0.20 insh, V2 has launched, have to see how it goes

TRU, Treasury vault launching soon in July , 4-6% yield.

ROOT has postponed the launch to 26th July due to a security audit.

Metaverse + Infra

Syntrophy prices have been dropping, the team is still working on the tokenomics.

Explore

DEFI

same as last month, using chainedge as the main tool to find alpha

NFT

Hodl on to my realvision, AEVO and ROOT Nfts

Returns and Recurring Income

Has been stable

STOCKS

Exited SPLK, hodl to PLTR, S, PATH, CALM, LUM, NOK, trading ETH and LINK as well.

June Strategy

Stacked more NOIA, RBN, ETH when possible.