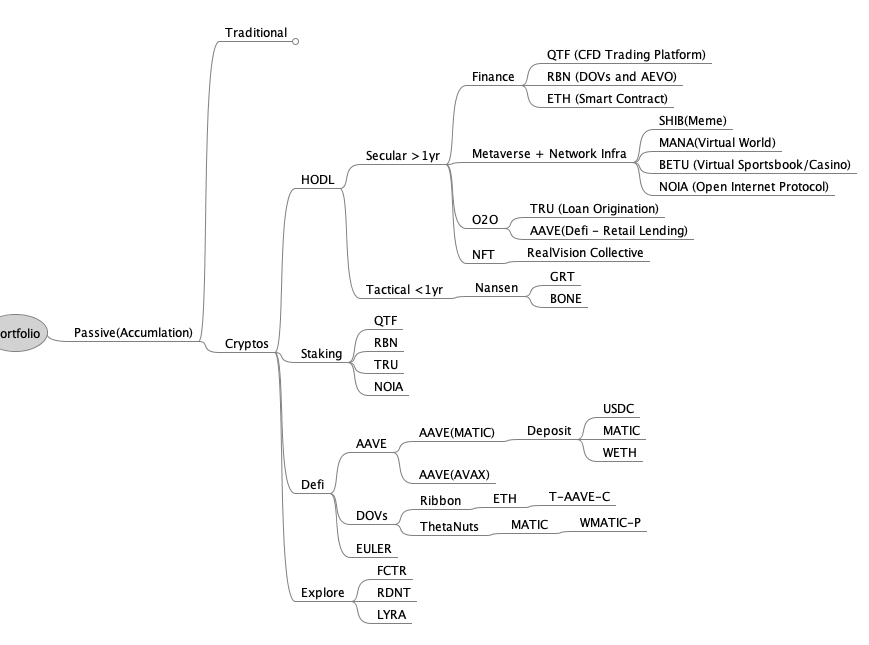

Portfolio Feb 2023 Report and March 2023 Strategy

Slight changes:

Finance↑

QTF price hovers around 9insh, they will launch a wealth management wallet in the 3rd quarter, still debating whether to include the spread as a part of QDT. Hopefully have more news.

RBN price has come down to 0.21- 0.25 insh, and waiting for AEVO to lanched. In the mean time, they will also build on BASE, if they are successful, it could introduce 100 mllion registered users to use AEVO or RBN products.

Eth, nothing more to add but just keep adding

Metaverse + Infra↑

All has been stable and been bouncing a bit, will still continue to accumulate NOIA. Syntrophy has announced new stack back in feb 2023 for enterprise users and provide 50GB free for testing the stack. They are now working to migrate the blockchain from eth to cosmos, and rebuilding the tokenomics, and planning to launch fiat payments for using the stack in 2Q.

O2O (offchain to onchain Lending)↑

Interestingly, that TRU has shot up in value, not sure if its related to TUSD or the new credit vault being launch in the future, will need to check.

Explore

Exploring chainedge tool as well.

DEFI

Unfortunately, the move to R.earn did not materialize due to the state of Crypto back in Nov last year. Instead, looking forward to moving to Arbitum layer for either RDNT, LYRA or FCTR.

NFT

Finally into NFT space, bought RealVision NFT and see how it goes, excited to what it entails in the future.

Returns and Recurring Income

Has been stable

Mar Strategy

Stacked more NOIA, RBN, TRU, FCTR when possible.