May 6th Expiry

NASDAQ

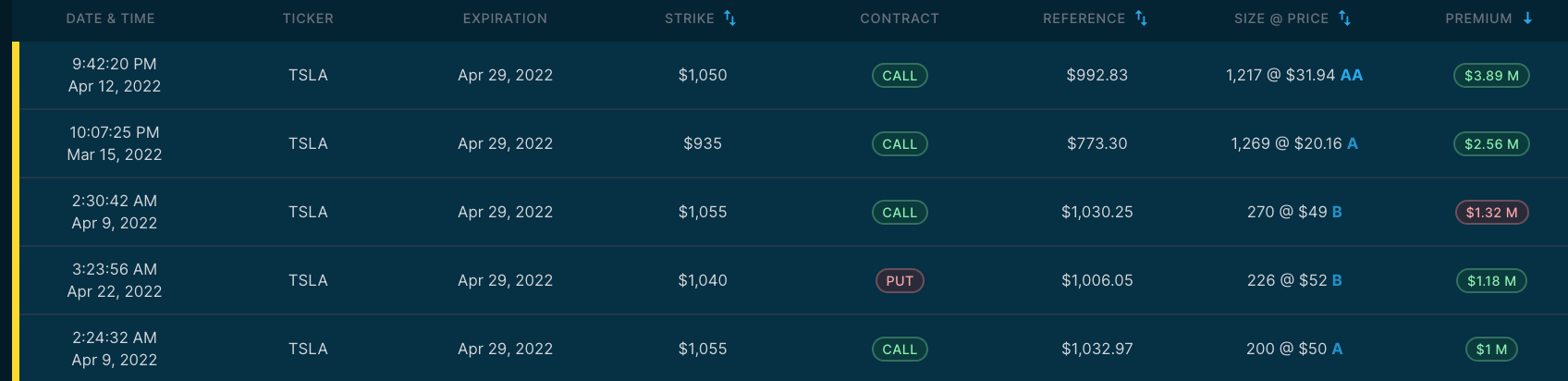

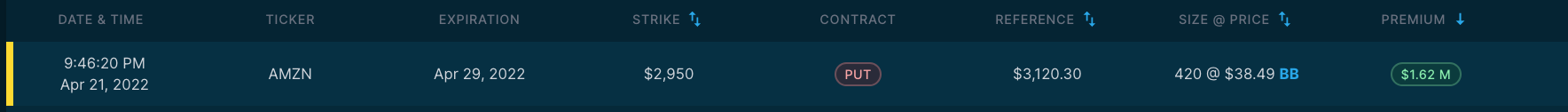

- AMZN

- TSLA

- TMUS

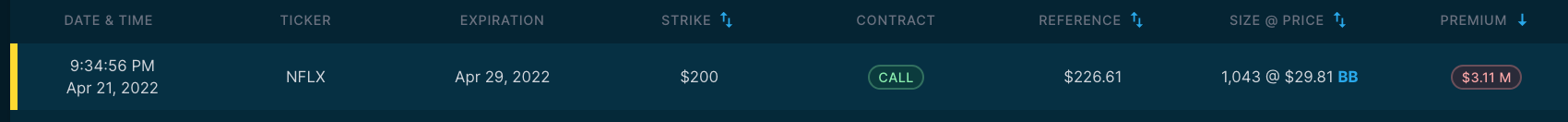

- NFLX

- NVDA

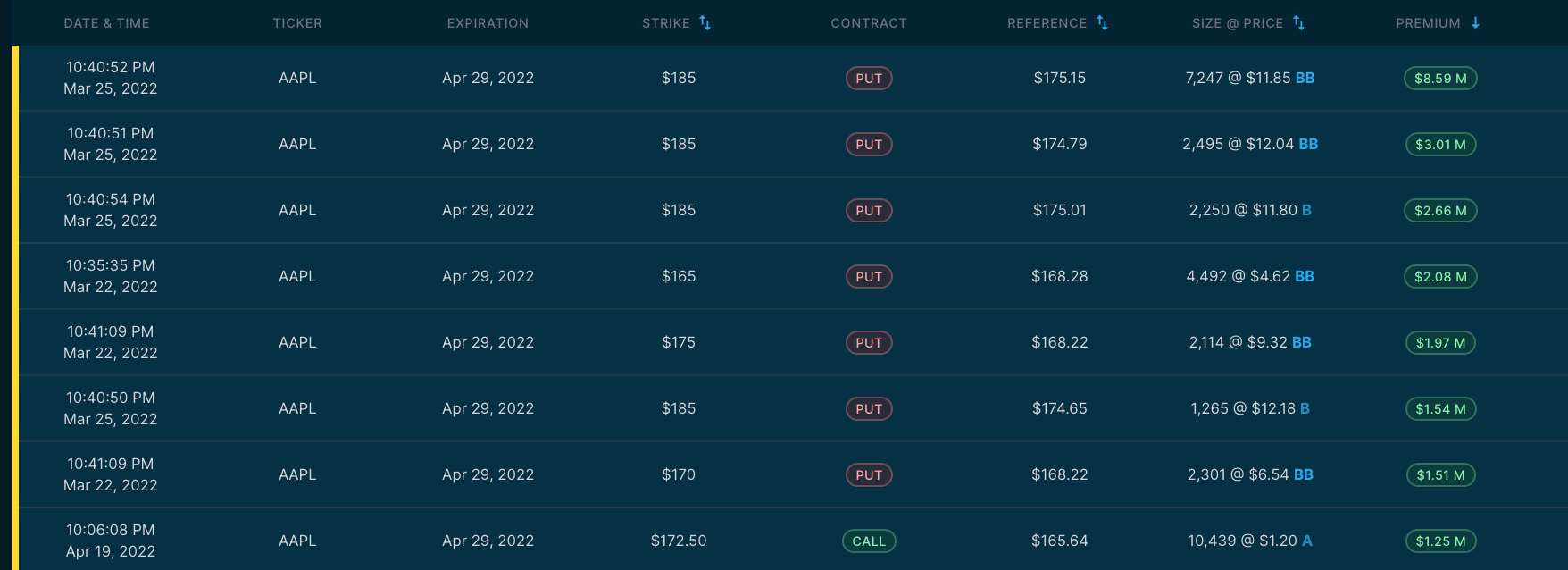

- AAPL

- AMD

NYSE

- F

- SQ

- NIO

- HD

- C

- CRM

- CCL

- LVS

- SE

- DIS

May 2nd

Top gainers/losers for April 29th

Bullish

- F

- PYPL

- BA

- TSLA

Bearish

- INTC

- COIN

Trade plan

- F * bullish

- PYPL - bearish

- BA - bearish

- Coin - bearish

- TSLA - bearish

May 3rd

Still in the trade:

Bullish

- F: May 27, 5.58 million , Dark pool is 60 million

- DOCU:

- Sep 16, 63 million

- May 20, 36+33million

Top gainers/losers for May 2nd

Bullish

- AMZN

- NVDA

- BA

- CRM: may 20th , 25 million

Bearish

- AMD

- PBR

Trade plan

- NVDA - Bearish

- TSLA - Bearish

- CRM - Bullish

May 4th

Top gainers/losers for May 3rd

Bullish

WDAY*, June 17th 90 million vs 22 million

Bearish

- TSLA

- ATVI

Trade plan

Still in the trade:

Bullish

- F:

- MAy 6, 7.36

- May 27, 5.58,1.94, 1.25, 1.16 million , Dark pool is 60 million

- DOCU:

- Sep 16, 63 million

- May 20, 36+33million

Long term play

- Buy WDAY, slowly scaled in as options non-existence till May 20th

- Add on DOCU

- Stay put on F

Short term play - within this week

- Sell TESLA

- Sell LVS

- Buy AAPL

May 5th

Top gainers/losers for May 4th

Bullish

- BYND

- AAPL

- AMZN

Bearish

- XOM

Trade plan

Still in the trade:

Got stopped out in DOCU, will go in again

Bullish

- F:

- MAy 6, 7.36

- May 27, 5.58,1.94, 1.25, 1.16 million , Dark pool is 60 million

- DOCU:

- Sep 16, 63 million

- May 20, 36+33million

- AAPL, May 6 more than 20 million

Bearish

- LVS - stay put

Long term play

- Buy WDAY, slowly scaled in as options non-existence till May 20th

- Add on DOCU

- Stay put on F

- Sell BYND - may 20th

Short term play - within this week

- Sell TESLA

- Hold on AAPL

- Hold on LVS

- Buy SQ, strike at 125

May 6th

Top gainers/losers for May 5th

Bullish

- TSLA

- PYPL - June 17, 20 mill

- ADBE - May 20th, 40 million

Bearish

NFLX

Trade plan

Still in the trade:

Got stopped out in DOCU again, will go in again, same for AAPL and WDAY

Exited LVS with a small win

Bullish

- F:

- MAy 6, 7.36

- May 27, 5.58,1.94, 1.25, 1.16 million , Dark pool is 60 million

- DOCU:

- Sep 16, 63 million

- May 20, 36+33million

- AAPL, May 6 more than 20 million

Bearish

- LVS - stay put

Long term play

- Buy WDAY, slowly scaled in as options non-existence till May 20th

- Add on DOCU

- Stay put on F, build positions when possible -till May 27

- Sell BYND - may 20th

- BUY ADBE and PYPL

Short term play - within this week

- Sell TESLA