Portfolio June 2022 Report and July 2022 Strategy

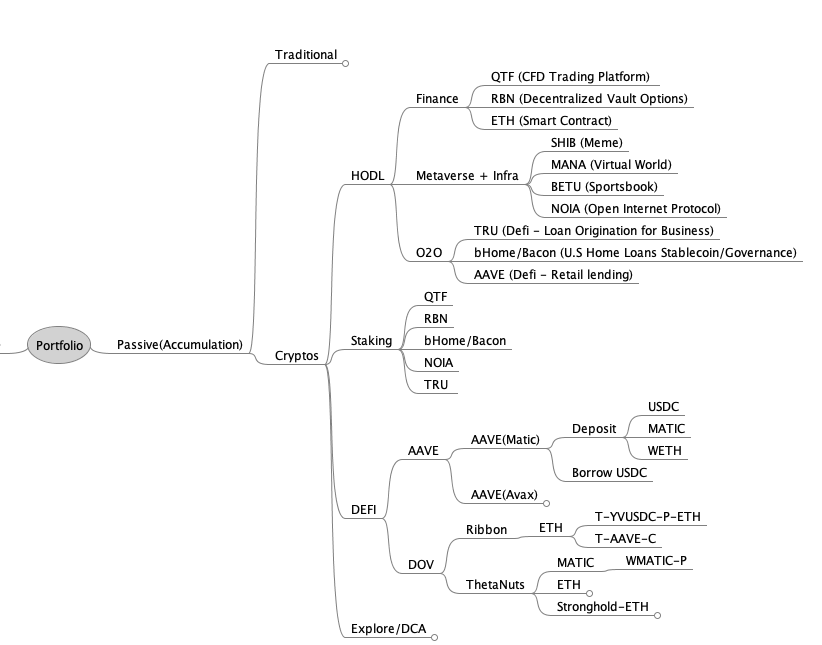

June portfolio as follows:

Same as previous month. June has been a difficult month where the UST collapse impacted other Crypto entities from Celsius, Blockfi, to 3AC.

Finance

QTF price has dropped down to 5insh due to the overall market sentiment.

RBN, the developers keep on building products and partnership. Will continue to accumulate

Eth, nothing more to add but just keep adding

Metaverse + Infra

Everything has dropped but will still continue to accumulate NOIA

O2O (offchain to onchain Lending)

Nothing much has changed, keep on HODLing..

Explore

instead of server, looking into cloud VPS for staking for NOIA nominator

DEFI

will move from AAVE to DOV once the change arises - not changed

Returns and Recurring Income

My HODL portfolio for June has returned slightly over 5X, with 6 coins in the loss:

BETU, RBN, NOIA, SHIB, MANA,TRU

Recurring income has dropped to a three-figure range.

JUNE Strategy

- Stacked more NOIA ,RBN when possible.

- Trade with Quantfury and using options data to trade