20 Jan Trades

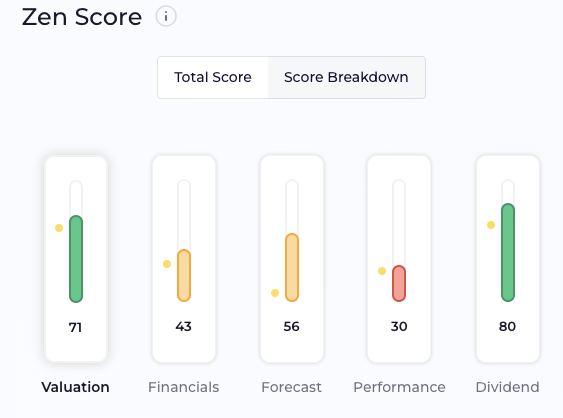

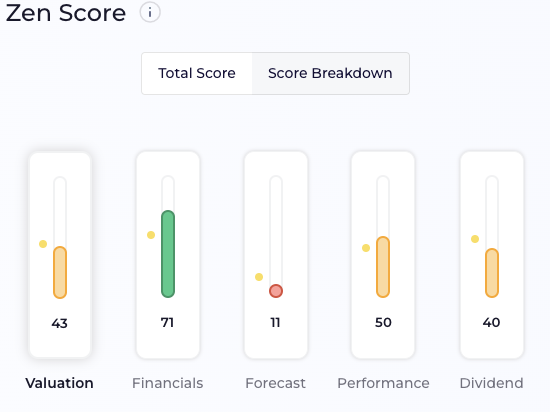

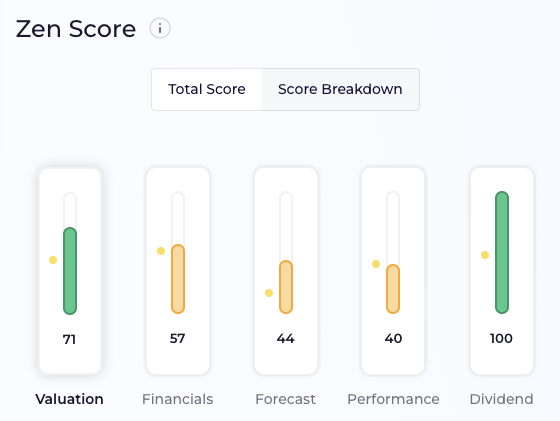

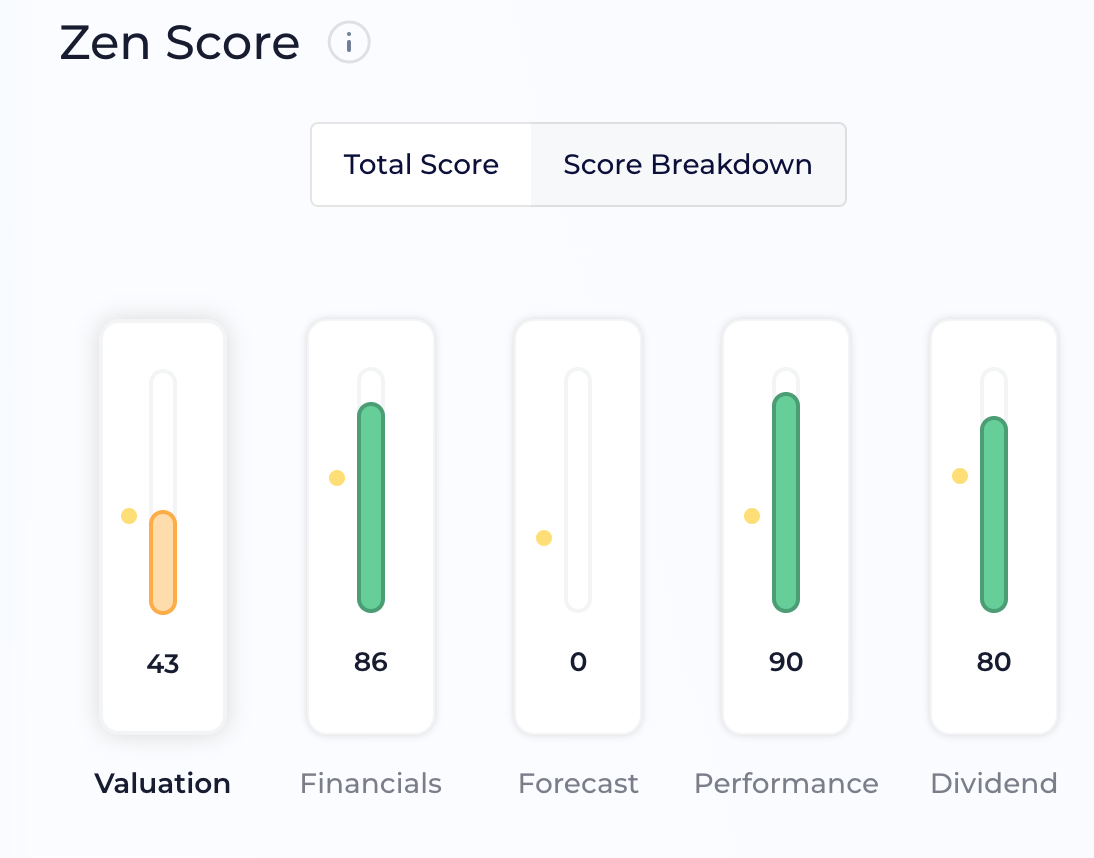

PFE

https://www.barchart.com/stocks/quotes/PFE/options?expiration=2023-02-03-w

https://www.barchart.com/stocks/quotes/PFE/options?expiration=2023-02-03-w

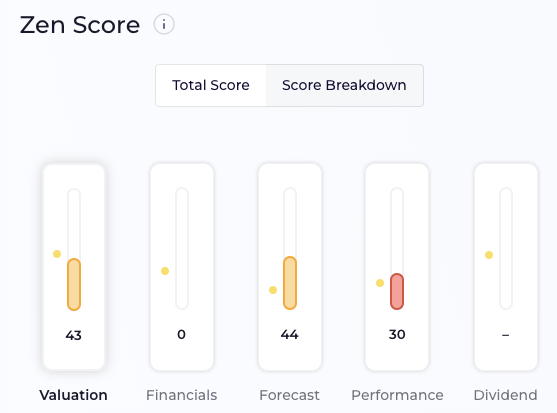

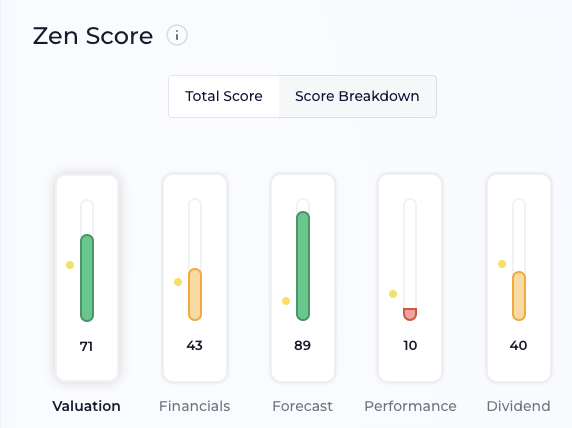

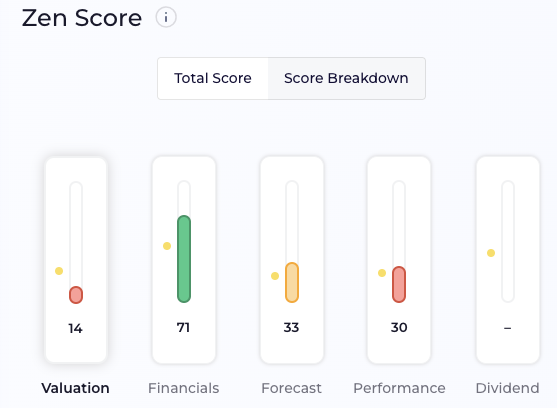

UMC option is expiring on jan 20th with 7.50 strike price hit, and $10 strike price, see ->https://www.barchart.com/stocks/quotes/UMC/options?expiration=2023-01-20-m , planning a scalp trade tonight.

Revisit after 20th jan options

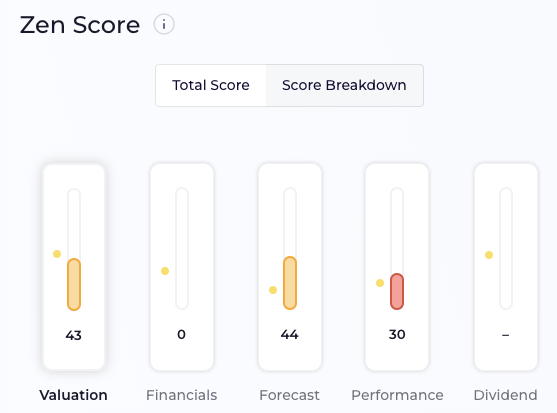

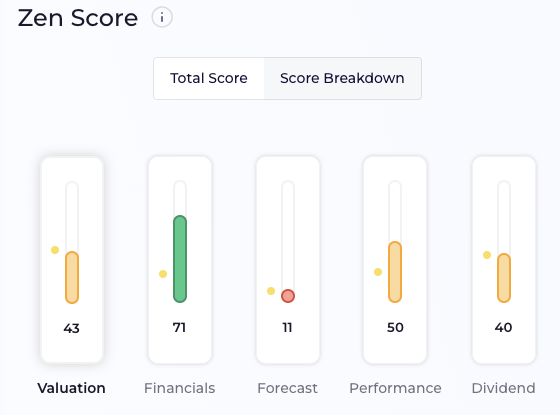

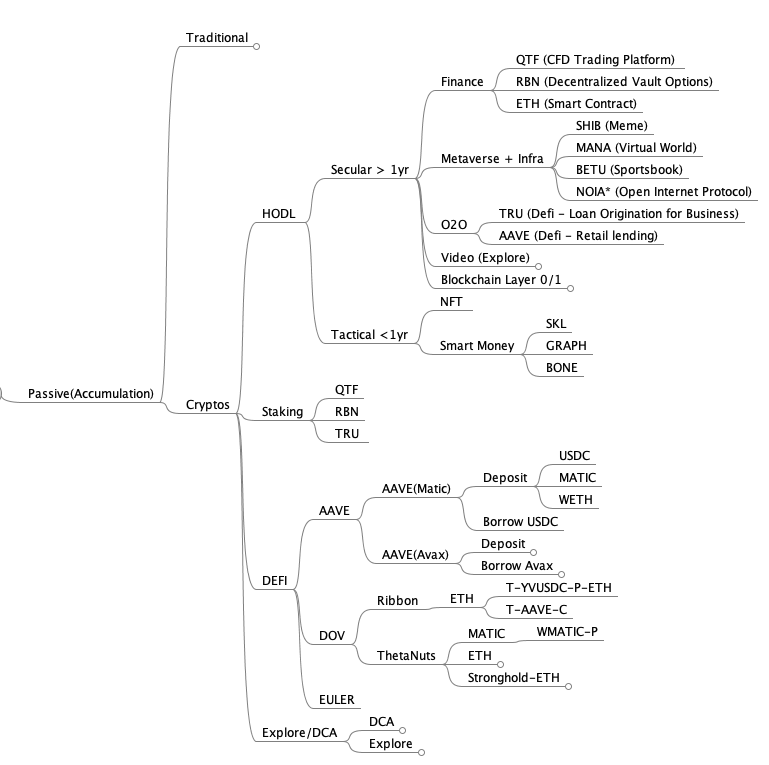

No change from Dec 2022, see here.

Planning to relaunch site and add more onchain analysis, and stocks stuff

Same as Oct:

Been away for the holidays for a while; hence, the delay, nothing much as change, was not hit by the FTX debacle.

QTF price has dropped to 8-9insh, they have launched fractional trading.

RBN price has been stable around 0.32- 0.35 insh and they are aggressively launching and building products like R.Lend, R.Earn, and Aevo, the options exchange.

Eth, nothing more to add but just keep adding

All has been stable and been bouncing a bit, will still continue to accumulate NOIA, and new partnership with Zenlayer.

Nothing much has changed, keep on HODLing..

Explore

Exploring nansen tools and finding ways to profit.

DEFI

will move from AAVE to DOV or R.Earn once the change arises - not changed

Returns and Recurring Income

Same as July, been stable

Dec Strategy

Stacked more NOIA, RBN and BONE when possible.