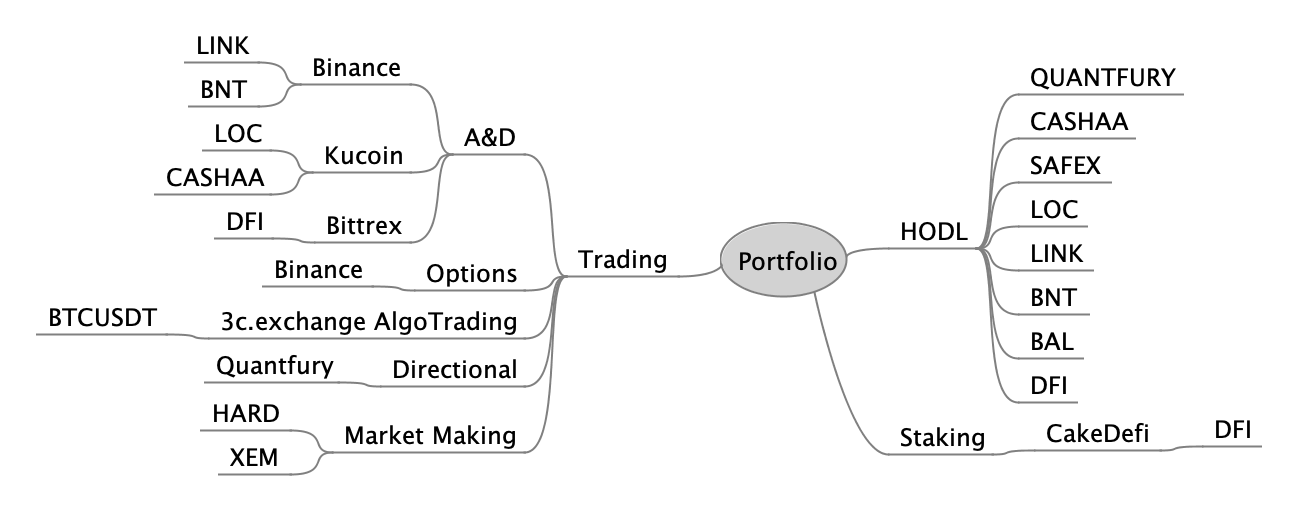

1Q 2021 Strategy

Did a review of the Crypto strategy in 2020 and will update every quarter of the year. See the following mindmap plan for 1Q 2021.

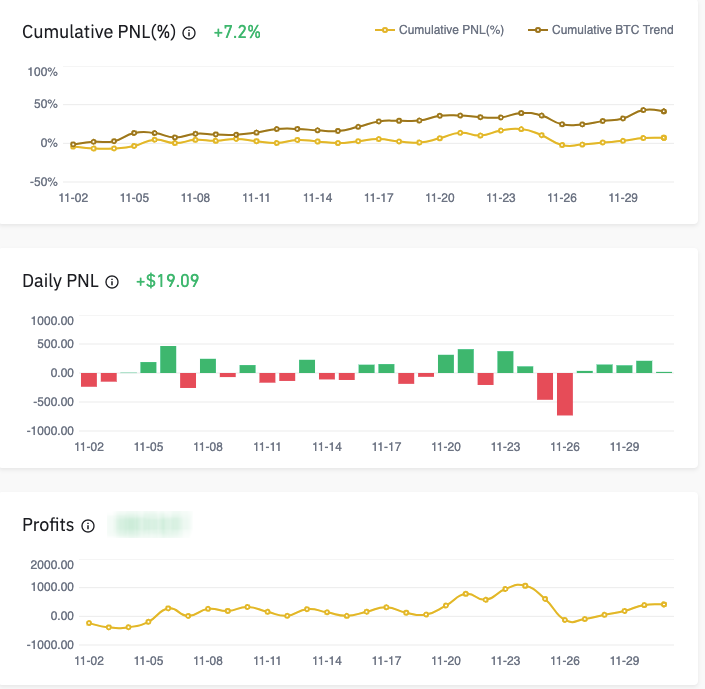

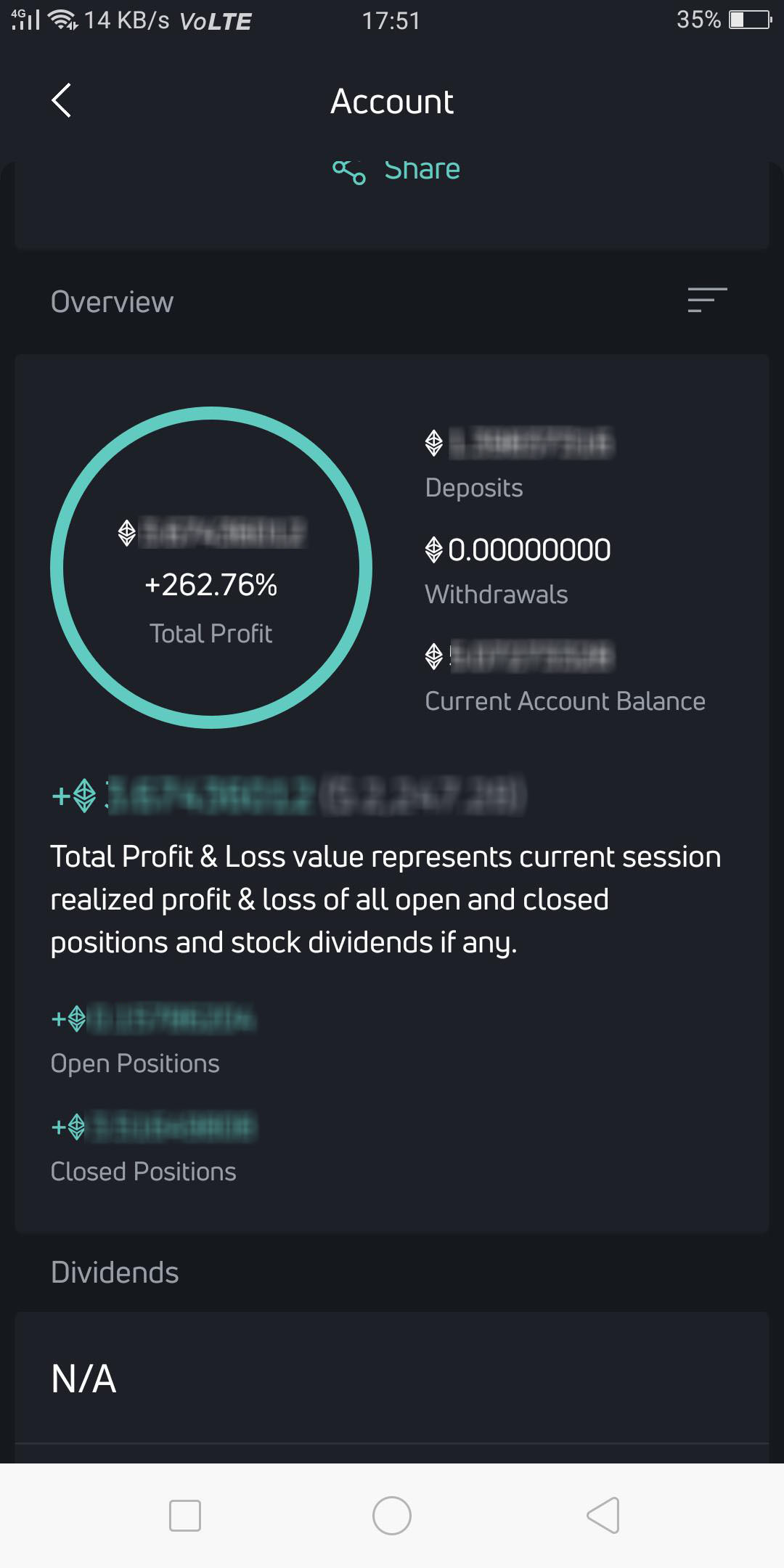

The Crypto space is moving very fast and will focus on DEFI stuff for the 1st Q, the new focus is CakeDefi with staking and sub-focus into Binance options using 3c.exchange. Hummingbot liquidity mining is still good but will focus on coins that have catered to more liquidity rewards and strong use cases, HARD and XEM are the focus now unless new entrants are in.