Portfolio April 2022 Report and May 2022 Strategy

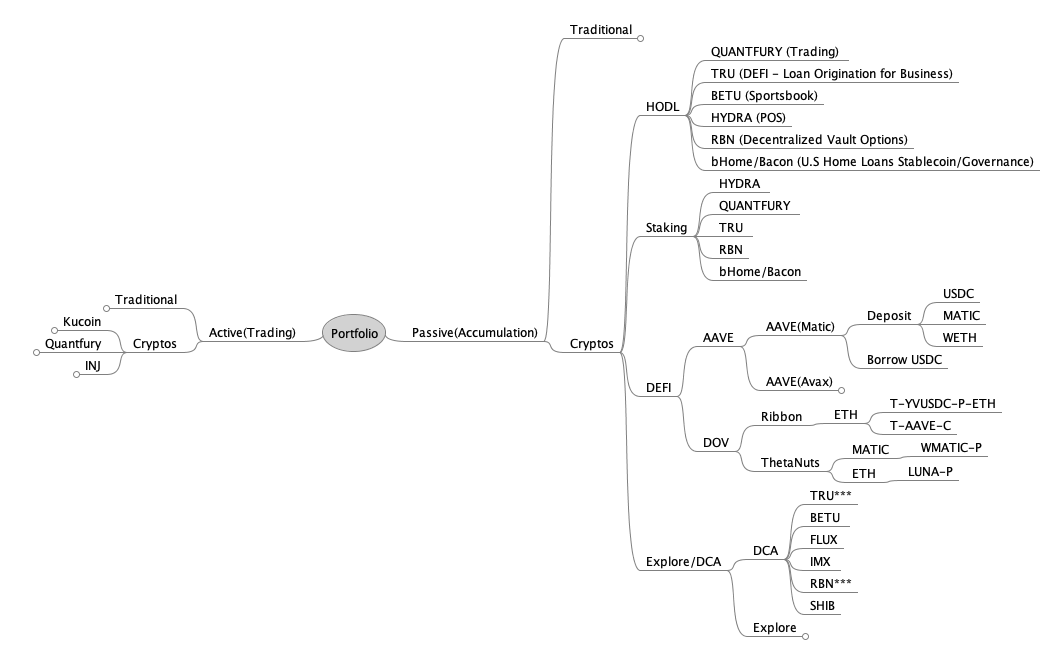

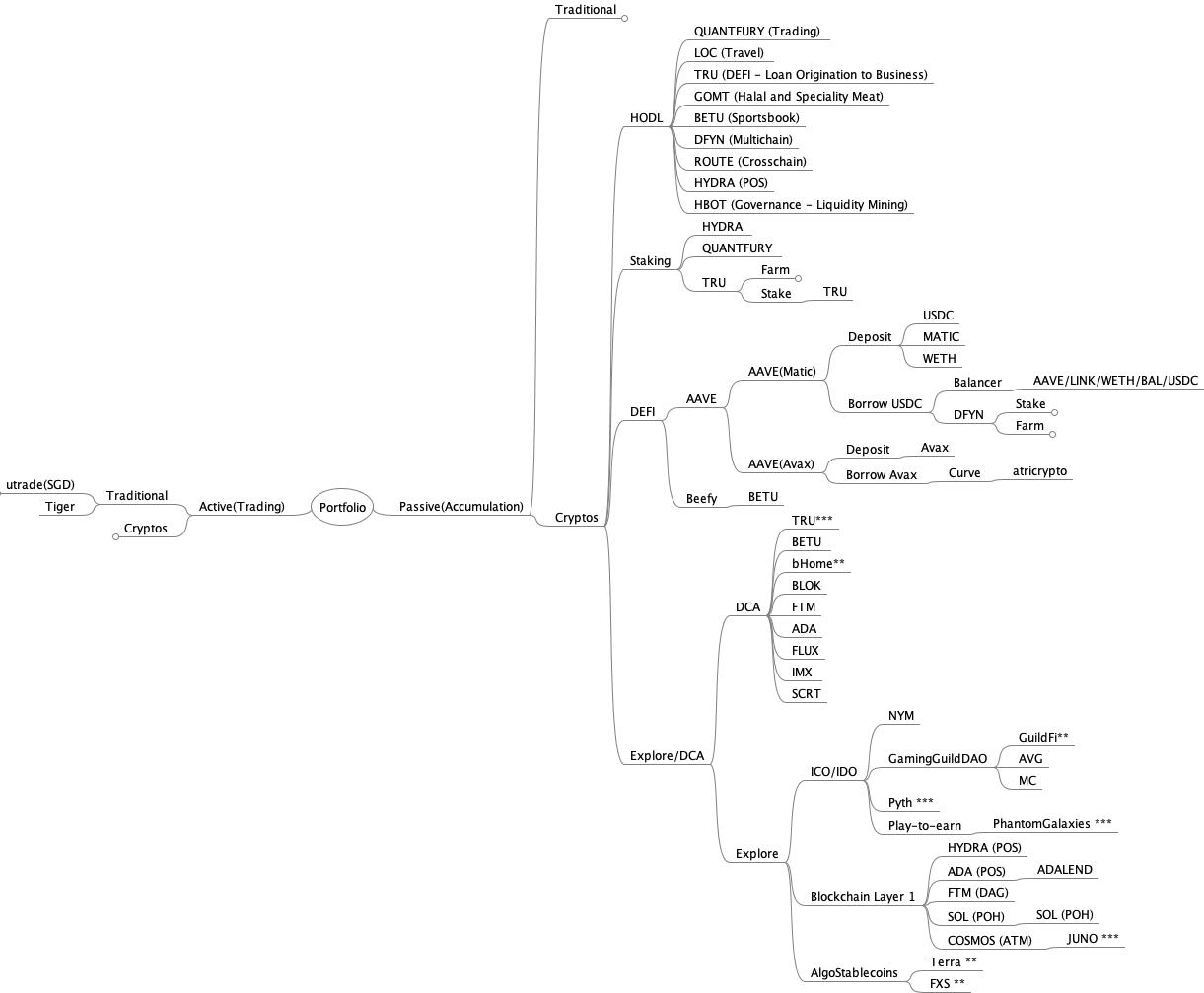

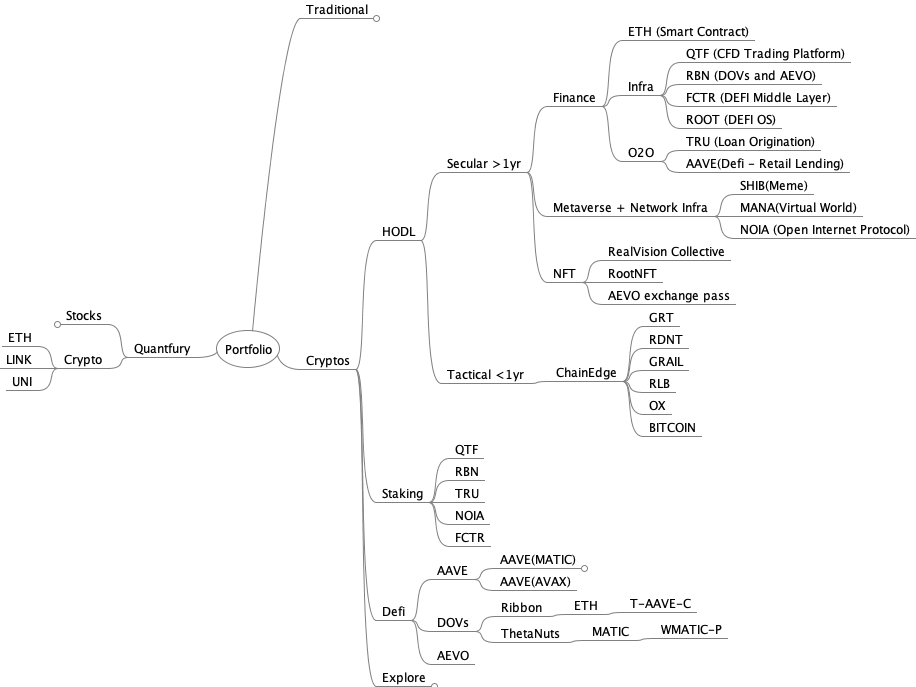

Categorized the portfolio. April portfolio as follows:

Ever since Hydra have finished seeding, there is more flexibility in freeing up capital to go deeper in projects that have more value IMHO.

HODL

In general, have decided to go with 3 categories:

- Finance

- Metaverse

- Infra

Finance

TRU price has spiralled down in price which is much expected and with the impending rate hikes by the FED and the last unlocking in August, price will continue to be more dovish. But, there are on-going work in the truefi front as they are moving towards DAO in June, and more companies are onboarding for the portfolio manager;thus, locking more TVL, and moving into mortgage loans with teller. The pace is slow but steady in bridging traditional finance over. Have increased the token holdings and with new tokenomics in June, looking at $1 at the end of the year.

QTF price has remain steady in the 10-20 range. They intending to announce in Q2-Q3 with. more on-ramp and off-ramp funding of the platform and hopefully the algo strategies which they have been harping for the longest time

RBN, keeping adding the tokens but there will be 150 million tokens unlocked in May 24th which might impace the price further. Nevertherless, still will keep accumlating this coin,

bHome/Bacon, BAU, just keep staking till end of the year or next till unlock fess are much cheaper, maybe eth 2.0 will help.

Metaverse & MEME

BetU price has remain stagnant but they are pushing for their betu casino, hopefully soon.

Shiba Inu, did some research based where MC/FDV is between 0.8 and 0.95, and decided hope in to be a degen of Shiba because the sheer amount of sentiment, and development work on-going:

- Shibarum L2

- Shiba burn portal

- Shib.io

- partnerships: welly burgers

It's like the little guys fighting against the goliath, ordinary folks VS the govt, Zergs rush :)

Though the burning will takes years to reduce the circulating supply, we'll see.

Mana

Same research as above in the FDV.

Infra

HYDRA price has dropped to 7insh due to liquidity rewards, this trend should continue, once it dropped to 6, will shift to Kucoin for staking as my current staking is around 2-3 days and Kucoin is 1 day.

ETH, enuff said.

Noia, is a new one, intend to accumulate this very low profile coin as its trying to solve latency issue by have thousands of nodes determining the best route for the packets to move;thus, blockchain is needed to reward the nodes and keep everything transparent. They are not trying to rebuilt on the internet or the OSI layer but built upon it. Once of the founders is ex-equinix founder.

Explore

Was looking at Flux but a bit lazy to built and maintain the nodes, will instead go into NOIA and stake as a nominator node.

DEFI

will move from AAVE to DOV once the change arises.

Returns and Recurring Income

My HODL portfolio for March has returned slightly over 87X, with 3 coins in the loss:

- 50% drawdown for BetU

- 33% for RBN

- 40% for TRU

- 18% for SHIB and MANA respectively

and recurring income has dropped to a low four-figure range but this is expected

April Strategy

- Stacked more TRU, NOIA ,RBN when possible.

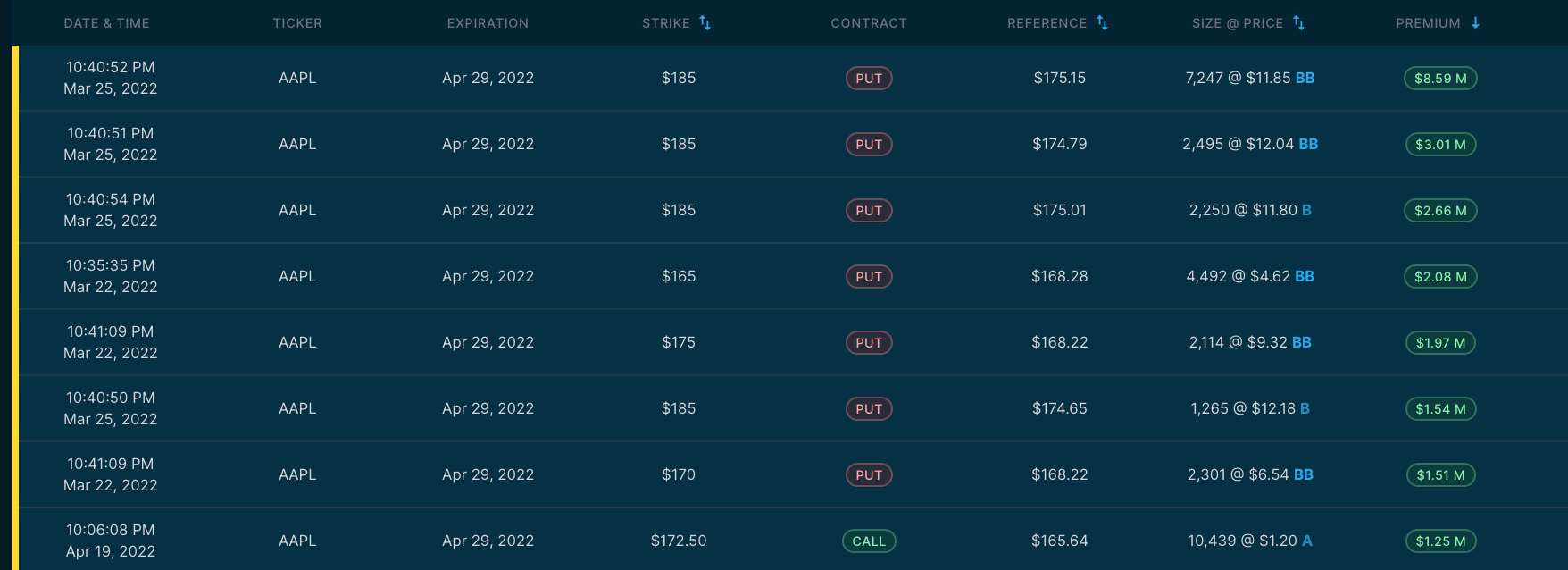

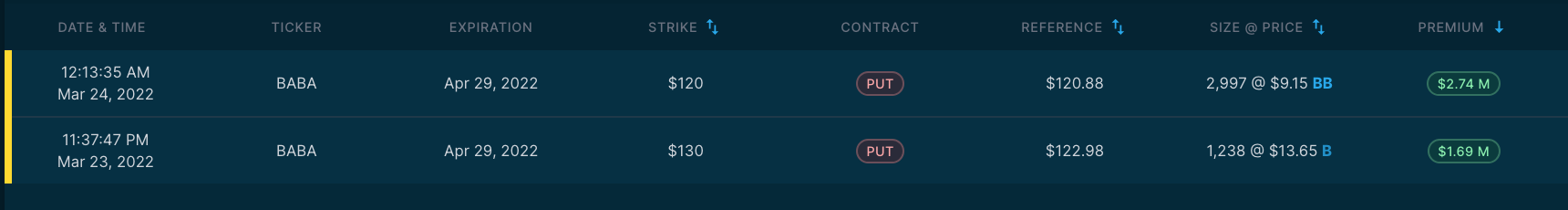

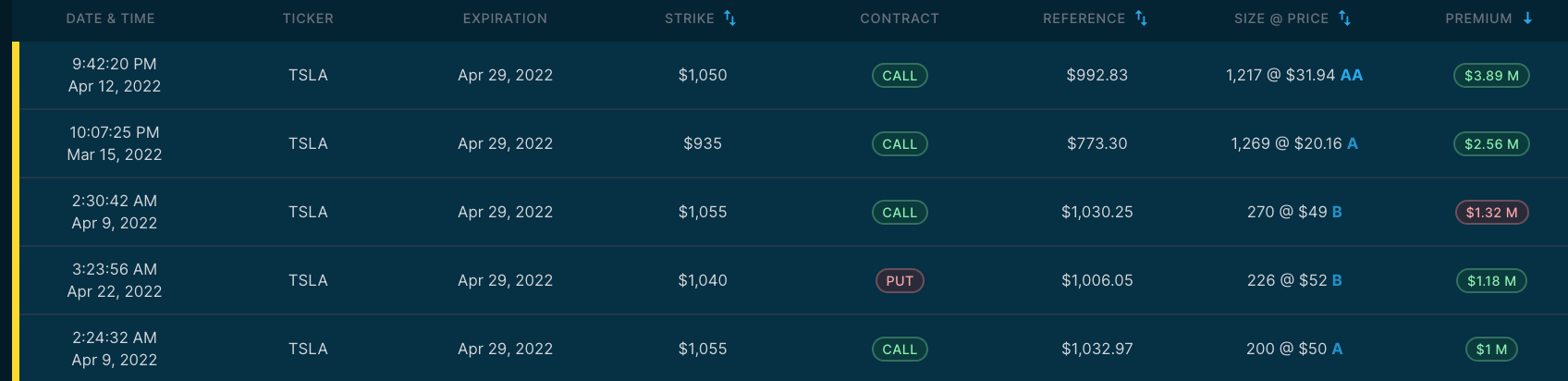

- Trade with Quantfury and using options data to trade