TradingView indicators ideas for Hummingbot

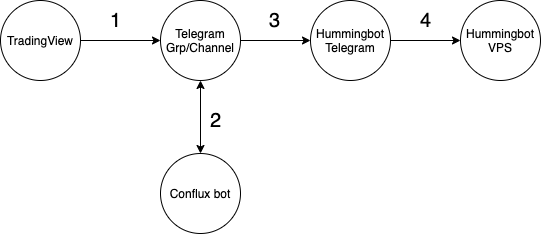

Now that we can send and control the start/stop commands from Tradingview to Telegram (see Link), let's explore some Indicators that can be used for certain parameters:

- Order levels and order spread

- Start/Stop

- Price band/Dynamic price brand(scripts)

Order levels and order spread

There are two indicators that you can use in Tradingview:

- Average pip movement

- EMA

See following screenshot:

The blue line on the price is the EMA while the bottom panel shows the average movement of the price, redline is the EMA and the blue is the average of the day. You can calculate the average percentage by taking average pip movement(EMA)/EMA, that is 0.00000021/0.00000398=0.0527. Then you multiply by 100, that is roughly 5.27 percent. What this means is the price moves around 5.27% a day. (You can adjust the settings to experiment which are the optimal settings) Based on this percentage, you can set your order levels to 5, spread to 1% or up to your desired levels within the 5.27%, or whatever fits your boat.

Start/Stop

Depending on what strategies you want, you can use a trend following strategy, a simple moving average to start your bot during uptrend on stop your bot during downtrend, or accumulate more during downtrend. If you are a die-hard supporter of liquidity mining rewards and love the project/token very much but at the same does not wish to be suffering from down spikes, maybe volume profile will be a good way to explore, see https://www.tradingview.com/support/solutions/43000502040-volume-profile/ for details.

Volume Profile

In a nutshell, most of the price action trade within 70-80% (you can define the percentage) of the price range and will revert to mean(POC). See following screenshot:

The upper and lower lines indicate the boundaries of the price within 80%(you can set this to whatever amount you like), yellow line is the POC which price will revert to. How to use? Set your stop when price cross down the lower boundary, and start when the price cross back up. By setting this, your bot will always trade where prices are bound within 80% of the volume profile. The pros are that 80% of time, your bot will always be engaged in mining where most of the action takes place, and if prices move out of bounds (saves you from spikes down), the bot will stop till prices revert up.

Note: If you want a risk-free approach in holding and increasing the coin inventory, try using the cross-exchange maker making.

Price Band

Or you can use volume profile as to sell above 80% or buy below 20%. In this case, you wont be bothered by the whipsawed price actions within 80%, buy and sell at the extremes, this is similar to the price band parameters. The Hummingbot scripts which is enabled in v0.29 allows you to use a dynamic price band based on moving average price or you can customize the dynamic price band according to your own strategy. In short summary, there are three ways:

- Volume profile:

- start the sell orders when above 70-80%, stop when price cross down 70%-80%,

- start the buy orders when below 20-30%, stop when price cross up 70-80%

- Price band: manually set your buy and sell orders

- Dynamic Price band: Using scripts to dynamically set your buy and sell order

So what about the POC? another way is to change strategy when prices cross down the the POC by accumulating more coins, and when prices cross up POC, start to distribute (sell) the coins. However, this is still quite a manual process in Hummingbot unless develop own script.

Trend Following

There are dozens of TV indicators that you can use for trend following. You can start the HB during uptrend or stop the bot during the downtrend. The issue with stop the bot during the downtrend is in the event of a prolong downtrend, the average cost of the coin for the inventory is higher. You can do a dollar cost average during the downtrend by buying the coin at a higher spread level, increase order level, etc, so the average cost per coin will be lower, and when the price reverts, the time taken to return profit is hopefully faster. Again, if the downtrend persist for a few months, you will be trapped with a large inventory and will have to ride it out. IMHO, don't use it for smaller cap coins unless you really really have a strong sense with the coin that it can moon or only use it for the top 50/100 coins in Coinmarketcap.

If you don't have the time to change strategy on-the-fly, and trade on a short timeframe, try using ping-pong mode during the uptrend which hopefully perform a fast in fast out trade, and during downtrend - stop the bot.

Choices, choices, choices.

Mean reversion

Still pondering with some ideas with futures order for hedging but Hummingbot doesn't support this feature yet, will update on this post once futures is available.

Summary

Hope the article lets you explore more ideas in using various TV indicators to trigger Hummingbot.

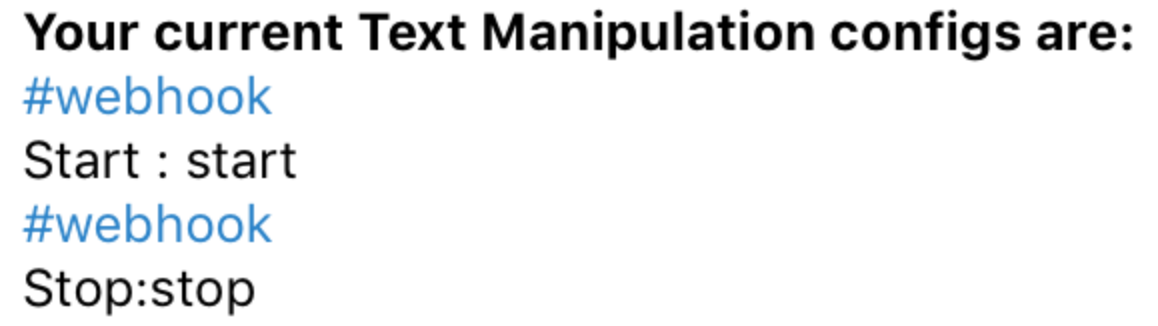

During the setup, there were some problems as the message from tradingview to channel/group has addition message of #webhook. Inorder to forward the correct messages, using text manipulation (by confluxbot) needs to be perform first before sending the commands to the hummingbot telegram.

During the setup, there were some problems as the message from tradingview to channel/group has addition message of #webhook. Inorder to forward the correct messages, using text manipulation (by confluxbot) needs to be perform first before sending the commands to the hummingbot telegram. Repeat step 17 for the stop For info on text manipulation: https://medium.com/@ak4zh/confluxbot-how-to-use-text-manipulation-feature-63b24fb9a93e

Repeat step 17 for the stop For info on text manipulation: https://medium.com/@ak4zh/confluxbot-how-to-use-text-manipulation-feature-63b24fb9a93e