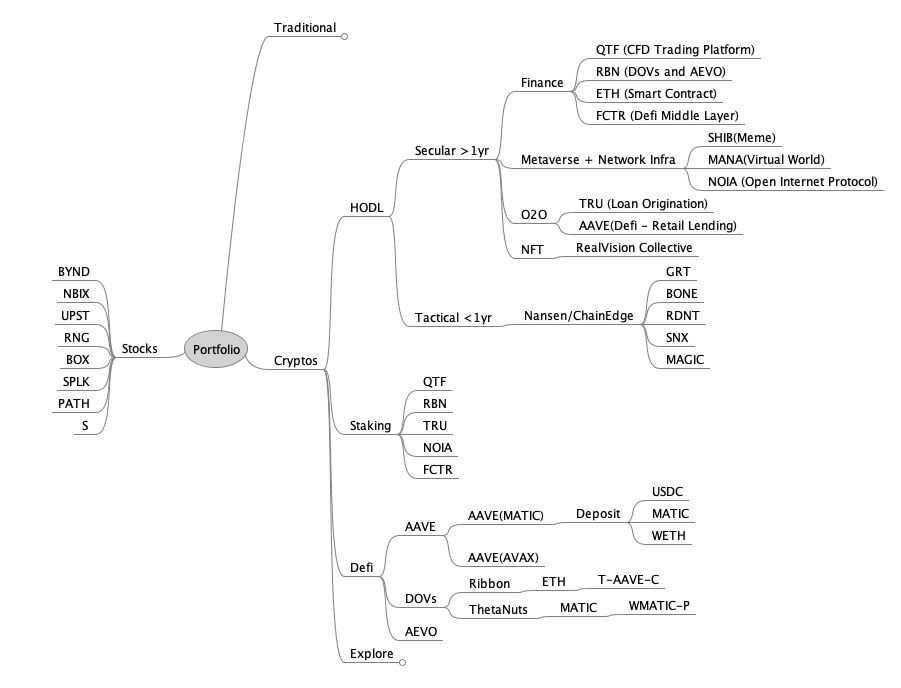

Portfolio Mar 2023 Report and APR 2023 Strategy

Some revamp:

Finance↑

QTF price hovers around 9insh, waiting for the wealth management wallet to be launched, i heard the max investment is 50k, hopefully will see it launch soon,

RBN price hovers around 0.20-0.25 insh and AEVO has launched, will need an exchange pass to use AEVO and will played with it

Eth, nothing more to add but just keep adding

Added FCTR, its a defi middlelayer in Arb, interesting project where it can linked all other Defi projects in Arb where you can easily launch your own fund, and other stuff.

Metaverse + Infra↑

BETU is a failed project and they sold their coy to another investor, have to write it off.

Syntrophy is moving into DePINs (Decentralized Physical Infrastructure Networks) https://twitter.com/JSimanavicius/status/1643249063716962306

Still going to hodl SHIB.....

O2O (offchain to onchain Lending)↑

Tru has dropped back down to 0.07insh and seen TRU outflows, beginning to wonder my decision about truefi

Explore

DEFI

Shifted V2 polygon in AAVE to V3.... about time...

Have bought chainedge and using extensively to find trading edge in spot trading, to be used together with nansen to find confluence narrative.

NFT

Hodl on to my realvision NFTs.

Returns and Recurring Income

Has been stable

STOCKS

Added a new section where i list the trading stocks

Apr Strategy

Stacked more NOIA, RBN, TRU, FCTR when possible.