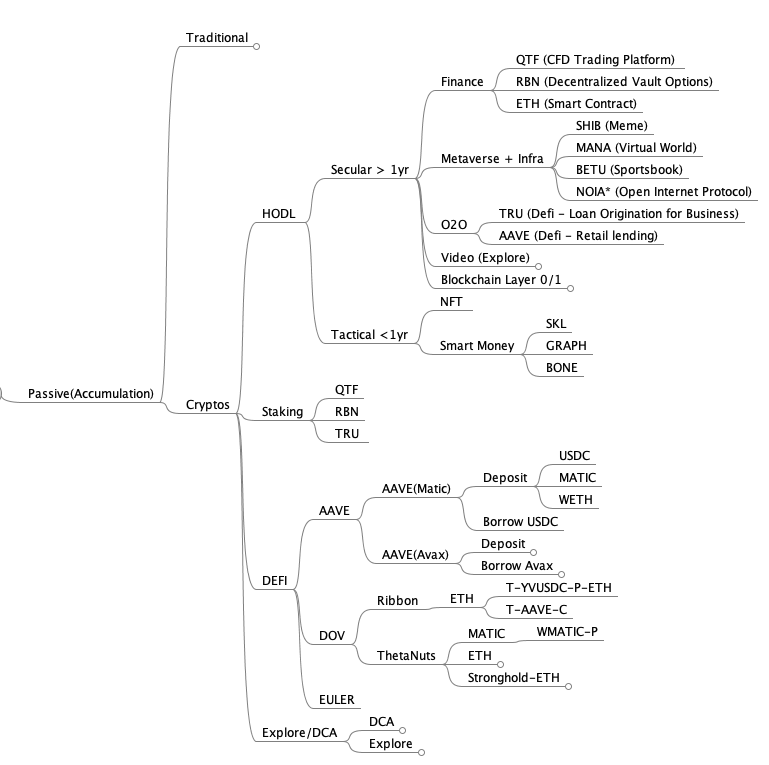

Portfolio Oct 2022 Report and Nov 2022 Strategy

Similar to Sep:

Nothing much has changed except moving out of Home/Bacon.

Finance↑

QTF price has remain stable around 10-11insh, they have launched a spot wallet, and no news on the algo products yet. I am guessing launching the spot wallet in a precursor to staking QTF for the algo products that will be launched this year end (hopefully) or other tracks like options.... well, maybe, we'll see.

RBN price has been stable around 0.32- 0.35 insh and they are aggressively launching and building products like R.Lend, R.Earn, and Aevo, the options exchange.

Eth, nothing more to add but just keep adding

Metaverse + Infra↑

All has been stable and been bouncing a bit, will still continue to accumulate NOIA. Recently, there was sort of sell off due a scammer about to scam tokens from the legal company representing NOIA. Well, there isn't a lot of official news on it, just have to wait for the official news.

O2O (offchain to onchain Lending)↑

Nothing much has changed, keep on HODLing..

Explore

Based on the qualitative analysis, have sold Badger, still in the trade for SKL and graph, make a mistake not to exit.

DEFI

will move from AAVE to DOV or R.Earn once the change arises - not changed

Returns and Recurring Income

Same as July, been stable

September Strategy

Stacked more NOIA, RBN and BONE when possible.