Portfolio Aug 2022 Report and Sept 2022 Strategy

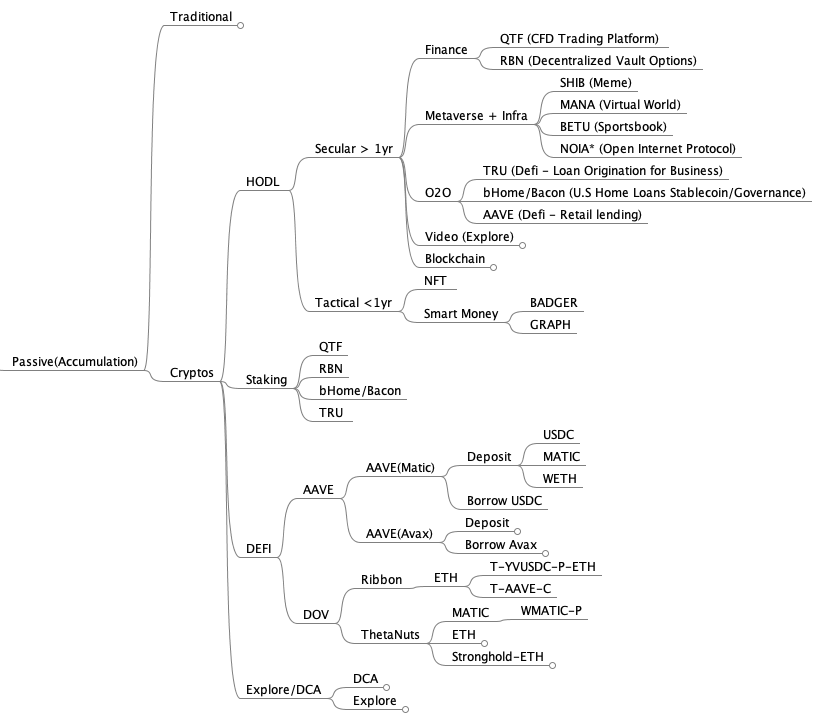

Aug portfolio as follows:

Nothing much has changed except have included two new category for HODL, secular and , the basis of creating two category is to differentiate the time horizon for the coins based on qualitative analysis through the use of tokenterminal, nansen, messari, TAs and other tools. Will address this in a separate post.

Finance↑

QTF price has spike up to 9insh, i guess new products for the on-ramp/off-ramp and the algo products is coming.

RBN price has been stable around 0.20-0.35 insh

Eth, nothing more to add but just keep adding

Metaverse + Infra↑

Everything has dropped but will still continue to accumulate NOIA

O2O (offchain to onchain Lending)↑

Nothing much has changed, keep on HODLing..

Explore

Based on the qualitative analysis, have decided to going into mode for graph and badger.

DEFI

will move from AAVE to DOV once the change arises - not changed

Returns and Recurring Income

Same as July, been stable

September Strategy

- Stacked more NOIA when possible.

- drop LPT, THETA and VRA as i an forming a framework for evaluating tokens.