TrueFi, My Pick for 2022 and Beyond!

Disclaimer: The content of this article is provided by Coincise. The content below does NOT constitute investment, financial, legal, or tax advice, nor does any of the information contained on this article constitute a recommendation, solicitation, or offer to buy or sell any digital assets, securities, options, or other financial instruments or other assets, or to provide any investment advice or service.

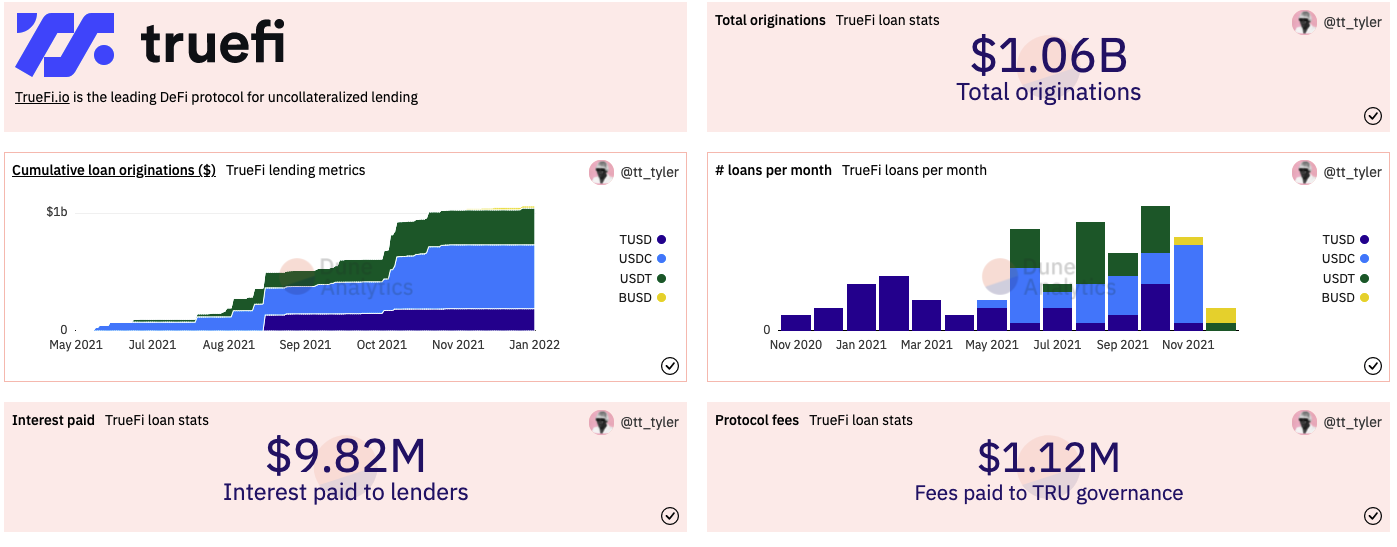

Truefi has done over a billion in loan origination since inception in 2020 Nov, paid $8.6 million in interest to lenders and $991k to TRU governance. For more info, see https://dune.xyz/tt_tyler/truefi-loan-stats .

Based on the latest blog post by the their CEO, https://blog.trusttoken.com/truefi-kicking-off-year-2-f1d836ba8a90 . Truefi is aiming for 1 Trillion in loans origination!

Very big hairy audacious goal indeed. In 2022, Truefi intend to target such as venture debt, corporate debt, CDOs & CLOs, and many more; meaning, bridging the gap to the traditional finance market! In order to deliver that trillion dollar target, Truefi has upgraded their lending engine to V5 (latest by Jan 2022) and a number of initiatives in 2022.

One of the initiative is opening TrueFi to 3rd party asset managers who will construct entirely new lending pools, servicing brand new types of borrowers. To test this,

Truefi has first to launch an independent lending pool on the protocol. With the proposal of the TrustToken Asset Management lending pool, designed to offer B2B loans under different terms than the existing TrueFi pools, TrustToken will take on the risks and complexities of making 3rd party support work seamlessly to build the best possible platform for future asset managers wanting to launch new financial products through TrueFi. see link

If the 3rd party asset managers initiative is successful, this can open up traditional finance folks in the lending space to join uncollaterized lending space. However, to attract the tradfi players, there are three items to V5 engine upgrade:

- Automating Loan Rating

- Borrower TRU Staking

- One-Click Borrowing

For details on the three items, see link.

Currently, the circulating supply is 548,956,194 with 3 more tranches of 33,562,500 to be released next year till August 2022 https://blog.trusttoken.com/truefis-tru-token-economics-7facea6651c0 ; thus, adding a total of 100687500 tokens by August 2022. With over 200 million TRU stake at Truefi, the floating supply is closer to 348 million, cex at 167 million (See https://etherscan.io/token/tokenholderchart/0x4c19596f5aaff459fa38b0f7ed92f11ae6543784) and at current price of 0.35 cents per token.

Based on the supply exchanges from Santiment (1 mth gap), the cexes has 150 million back in end nov, and this number has increased to 167 million ( manual calculation from etherscan). .

Based on the continuation supply in exchanges and tranches to be released, TRU price should be suppressed till 2Q 2022 whereby the 3rd party asset manager results should be clearer. Time to load up till then!

[Update 13Jan 2022] There will be a townhall on 14th Jan https://twitter.com/trusttoken/status/1481392467169660932?s=21. Hopefully i can attend cause it will be 2am my time...... zzzz , hopefullly more updates from me by then.

[Update 14Jan 2022] manage to get up and attend the townhall, the next level they are going for the protocol is to let traditional coys to originate loans through asset manager. this asset manager is basically a 3rd-party that will use trufi to borrow and manage money from the trufi community pool of funds. They have one coy in place - delt.ai and will start to look for more. they will release this new feature once audit is completed.

Truefi is going to charge 50 bips (as suggested by the CEO) for loans origination which can stacked up a lot in scale if they hit more than 1 billon in this year end, better if 1 trillion which is quite a tall target. We shall see.

The demo on the product is prototype but basically show the process of 3rd party asset manager registration, more details to be released later. TruFi tokenamics will be reworked for these changes and hopefully on the L2 front.

[Update 04 Feb 2022] Truefi has officially announced through Cointelegraph on the DeFi lending market for asset managers, see link. A sample of the announcement.

Delt.ai, a Mexico-based Y-Combinator startup, was announced as TrueFi’s first non-Crypto financial partner. Since December, the startup has used TrueFi to originate millions of dollars worth of loans and expects to lend up to $25 million to Latin American businesses by the end of 2022

[Update 28 April 2022]

News on three fronts, potential of more than 200 million (or more) in TVL

- https://forum.makerdao.com/t/signal-request-onboard-d3m-for-truefi/14563

- https://gov.frax.finance/t/fip-56-truefi-amo/1236

- https://medium.com/teller-finance/welcome-home-usdc-homes-on-teller-brings-Crypto-mortgages-to-texas-homebuyers-32f8dac87284

[Update 26 September 2022]

- https://blog.trusttoken.com/meet-truefis-lending-products-e60c9880a3f9

- https://blog.trusttoken.com/truefi-institutional-upgrade-472e86d21216

Reads

- https://polygontech.medium.com/the-Crypto-loan-economy-d788ac794b3c

- Truefi Partner pitch deck June 2022

- REFLECTION_DIGITAL_-_On-chain_to_Off-chain_O2O_Lending_May_5_2022 (1)

TL:DR, keep stacking more TRU because in the market, goldfinch, maple and tru are in the under/no collaterized lending market, and TRUEFI is one of the largest in terms if loans origination, 1 billion USD last year and no company has defaulted so far. Given the release schedule of the tokennomics till aug 16th, prices will continue to be suppressed IMHO and will be price 0.30 - 1.00 till 3Q. Time to load up!