Portfolio Aug 2021 Report and Sep Strategy

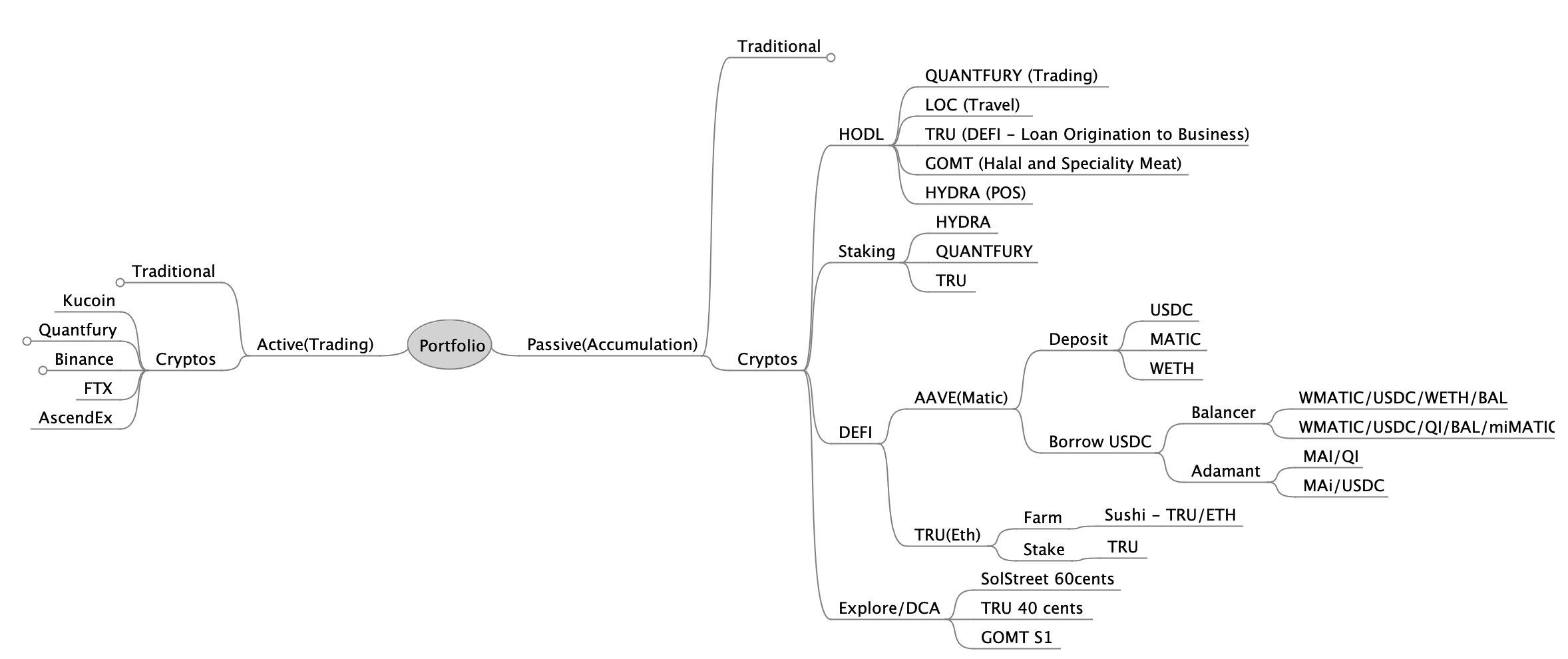

Aug is another calm and smooth month, same for the previous 3 mths since refining the strategy with minor tweaks, see the following mindmap:

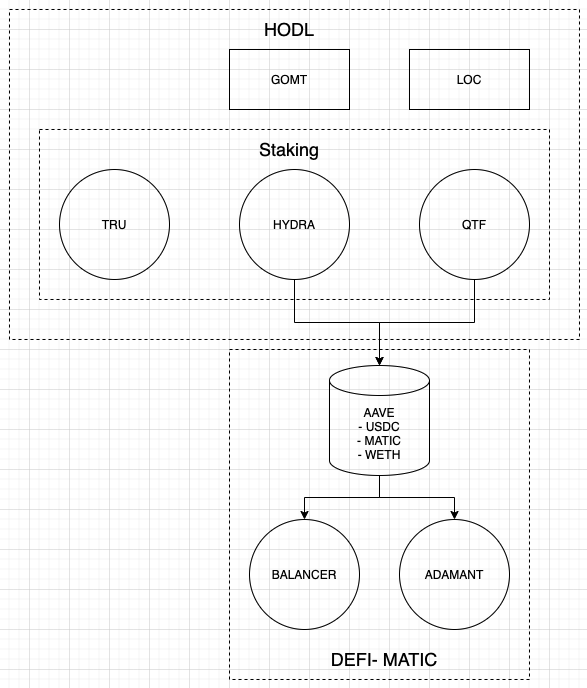

HODL

Pretty much the same.

GOMT is starting their tier 1 sale, manage to get some GOMT, pretty exciting about them since its first ICO i bought since 3 years ago. If you are interested, use my refferal link for extra 2% bonus, ontop of the current bonus of 15%. -> https://gomeat.io/icopanel/invite?ref=UD00097

TRU value is consolidating ard 0.45-0.70. Have stacked more TRU, now thinking whether to stake or wait for x2 price. Hmmmm.

QTF value has climbed back up to $8-9 range, users acquisitions has been climbing at fair stable 20k-30k users, but the real deal has always been the retention and the number of trades they execute and close in order to get the spread revenue which translates into QDT. July was pretty dry.

LOC - tried with facebook ads and google ads to get referrals, not much headway. Price has been stable above $6.

CAS - decided to drop them as they under deliver again... quite tired of them, managed to changed the amount to GOMT and TRU.

Explore

Solstreet is pretty interesting and i have entered their competition in phase 1, and now in phase 2. Looking forward to their mainnet and ICO. Another Crypto is Pyth, the oracle based on Solana blockchain.

Staking

Nothing has changed much except moving into TRU/WETH farming in Sushiswap.

DEFI

Still going hyper-compound Matic, invest in Balancer pool, and Adamant Pool for QI pool

Sep Strategy

Exploring Solstreet and Pyth, stacked more GOMT and TRU where possible.

Will still lookout to hypercompound Matic when the chance arises