MATIC hyper compounding through AAVE

Saw this video https://www.youtube.com/watch?v=kDJeWom5As0 and was a few months late but timing was a bit better as the Crypto market crashed in MAY and allow this strategy to be explored.

Decided to follow the video but it's not too straight forward;thus, decided to blog this so I can follow it again.

The general steps are:

- Switch ETH to Matic network

- Use Quickswap to exchange for Matic

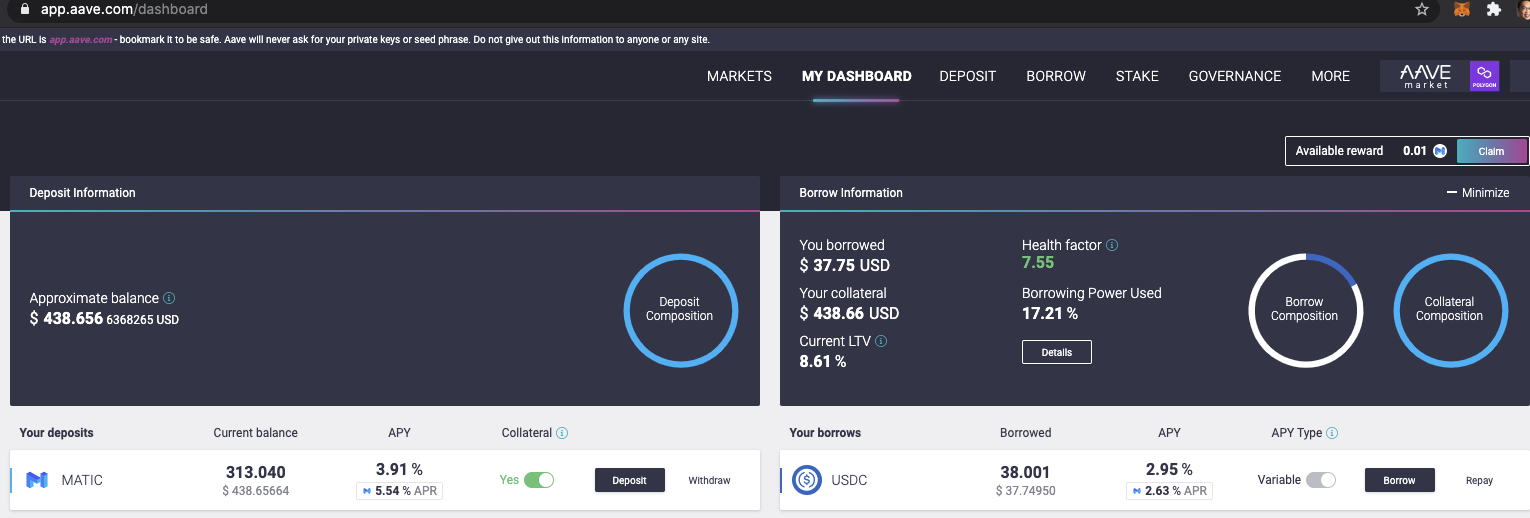

- Deposit to AAVE

- Borrow stable coins

- Quickswap for Matic

- Deposit to Matic

- (Optional) Repeat step 4-7 till you are comfortable with the risks, in general 20-30% LTV.

Did a test round and it's successful. The gas in MATIC network is almost negligible, given the high profile stage of this coin, it's good to accumulate this coin while borrowing (loop) in stable coins to add more MATIC and get more WMATIC to be redeposited in the pool.

Plan is to borrow USDC or which stable coins APR is lower during the uptrend of MATIC, and only buy MATIC during the downtrend using USDC. Maintain the LTV at 20-30% in case of a crash.

Let's see how it goes.