Portfolio May 2022 Report and June2022 Strategy

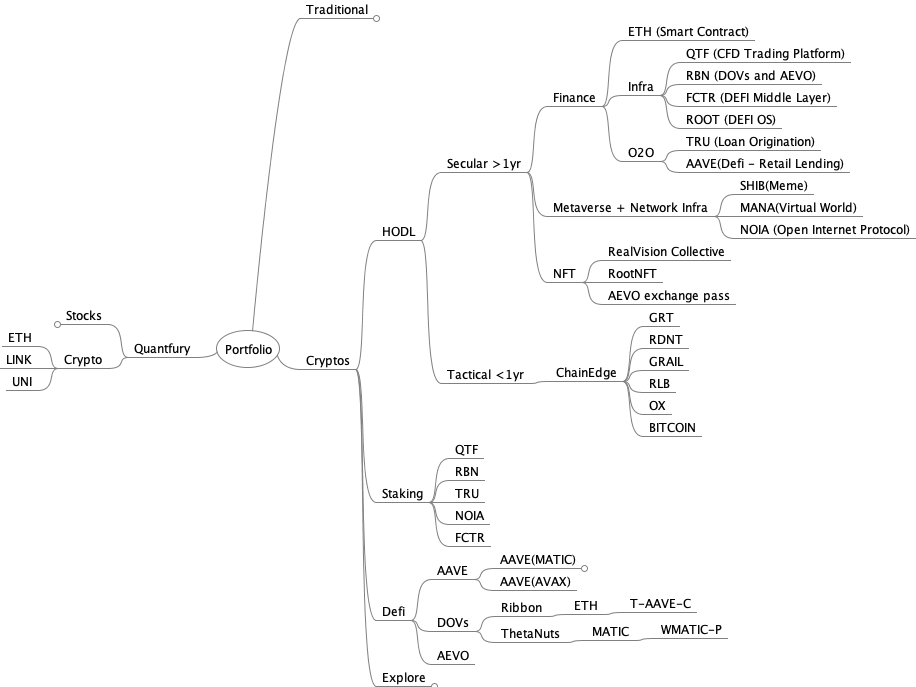

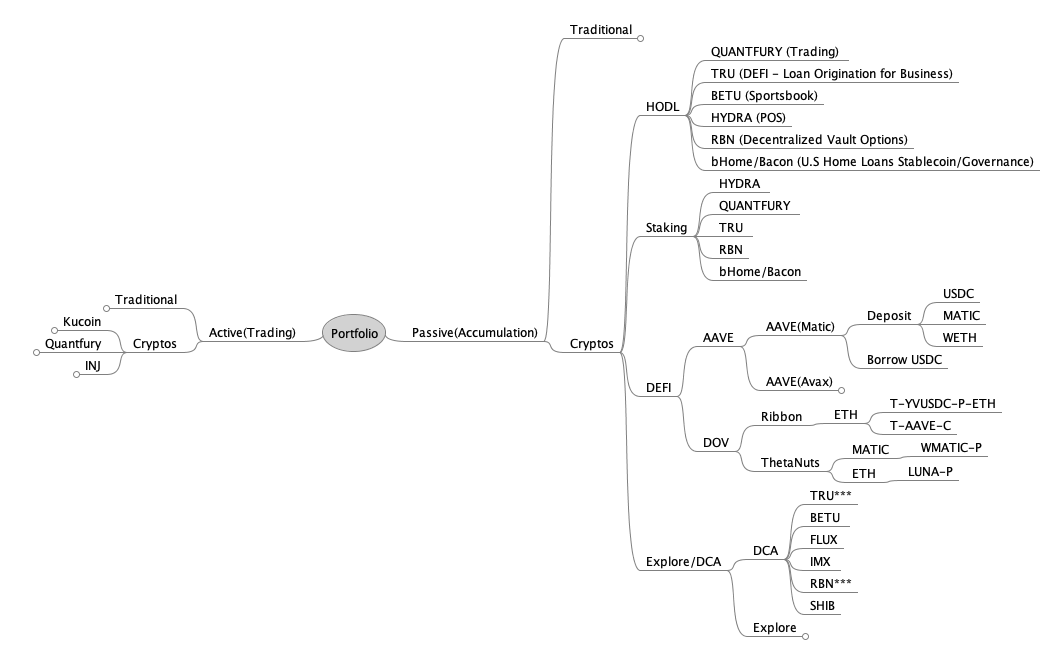

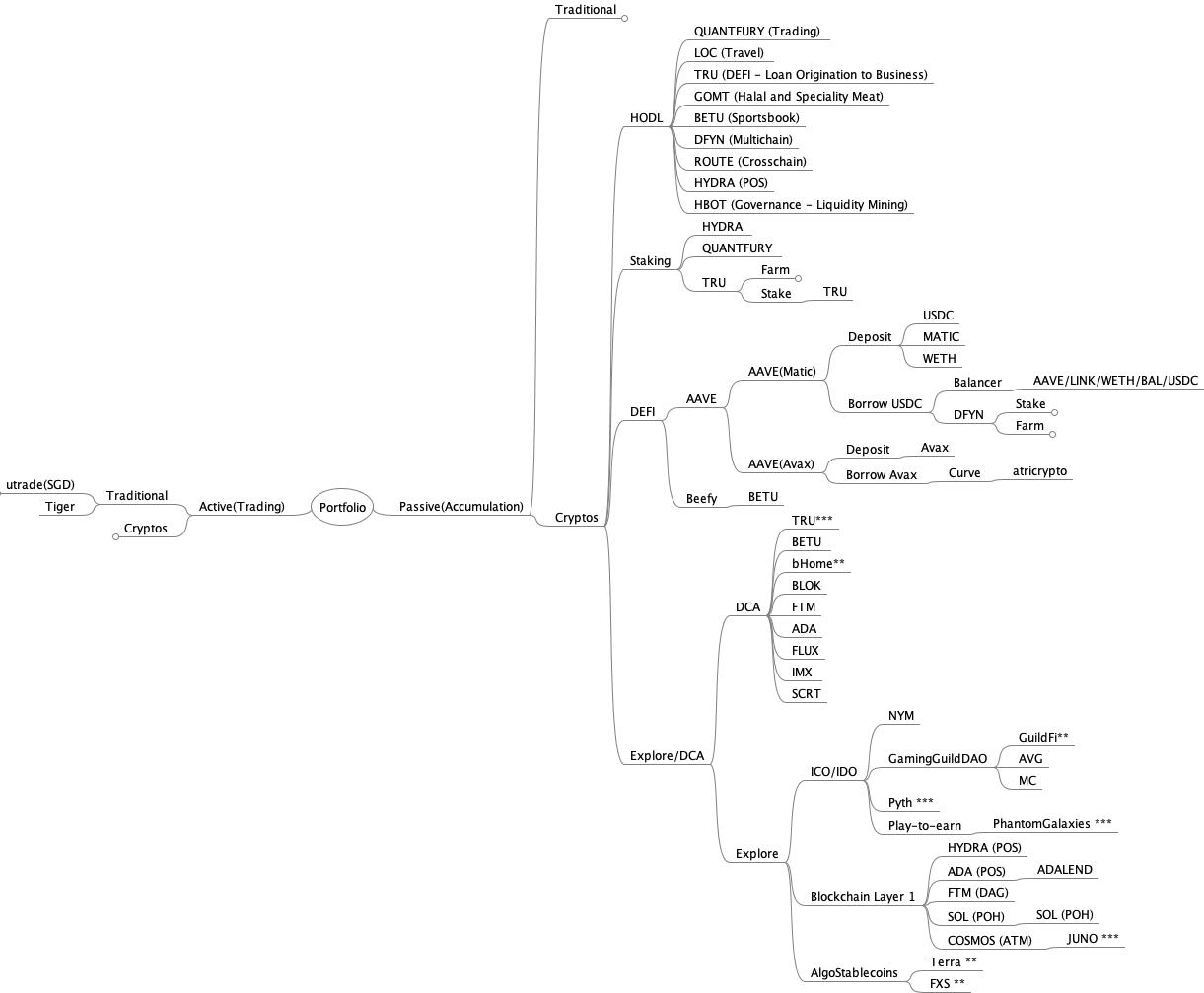

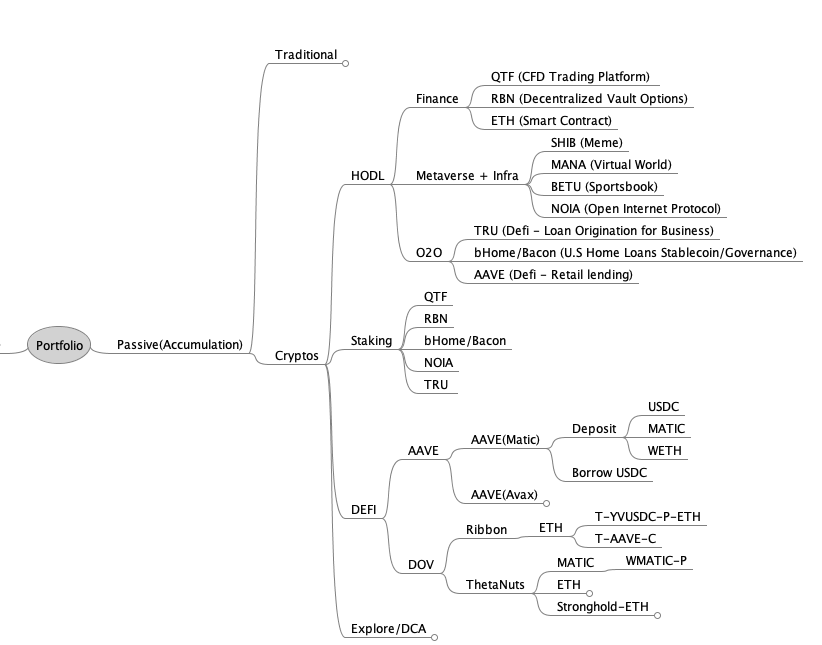

May portfolio as follows:

Got 3% rekt in LUNA vault of Thetanuts... was very sucky but oh well, seems a yearly affair to get rekt every May, need to reduce this rekt behaviour. But the overall portfolio went down by 50% cause due to LUNA, + overall market sentiment in tradfi as well and defi.

HODL

Combine metaverst and infra together, and added O2O

- Finance

- Metaverse+Infra (web 3)

- O2O (offchain to onchain lending)

Finance

QTF price has dropped down to 8-9insh due to the overall market sentiment.

RBN, the unlock happen and 10million tokens were added to the stake and locked for 2 years, the circulating supply has increased to 160 plus million. Will continue to accumlate

Eth, nothing more to add but just keep adding

Metaverse + Infra

Combined NOIA to metaverse;thus a new category, Metaverse + Infra

BetU, MANA and shiba price has dropped.

Noia, dropped to 0.07 insh, looking to buy a mini pc to act as a validator. will also accumlate as much as possible.

Have liquidated HYDRA as it no longer make sense to hold it due to the nature of the project and the market sentiment.

O2O (offchain to onchain Lending)

Change the previous Infra to O2O Lending which is more of a correct term for it

bHome/Bacon, BAU, will just keep staking till end of the year or next till unlock fess are much cheaper.

TRU price has been trading sideways, there will be a townhall meeting in June to discuss the DAO and other projects

AAVE, same as ETH, will use DOV ribbon to accumulate.

Explore

Looking at mini pc to host validator nodes instead of nominator

DEFI

will move from AAVE to DOV once the change arises - not changed

Returns and Recurring Income

My HODL portfolio for May has returned slightly over 11X, with 6 coins in the loss:

BETU, RBN, NOIA, SHIB, MANA,TRU

the big drop is due to hydra being exited to preserve capital and recurring income has dropped to a three-figure range.

JUNE Strategy

- Stacked more NOIA ,RBN when possible.

- Trade with Quantfury and using options data to trade