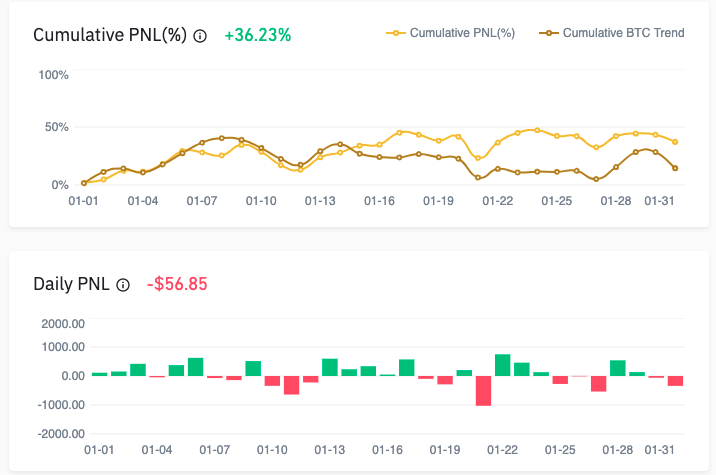

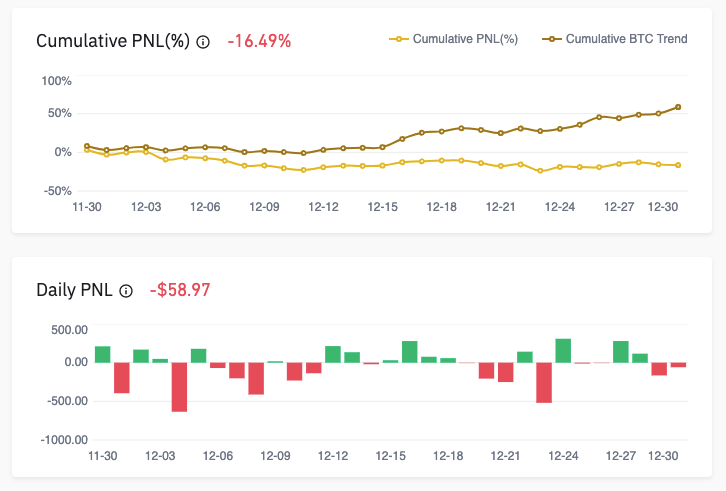

Feb 2021 Strategy

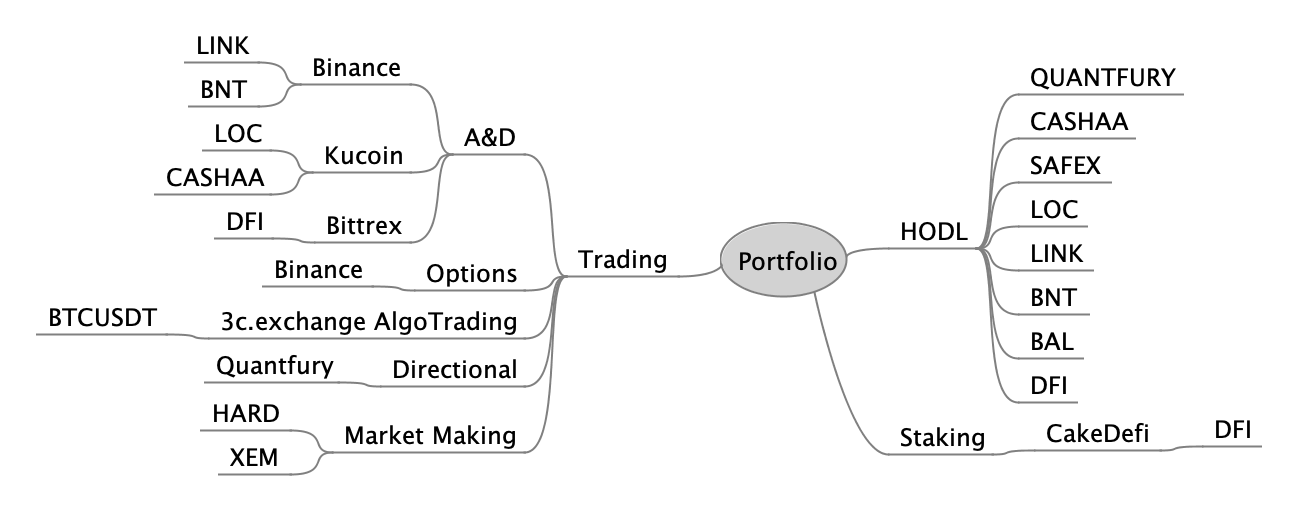

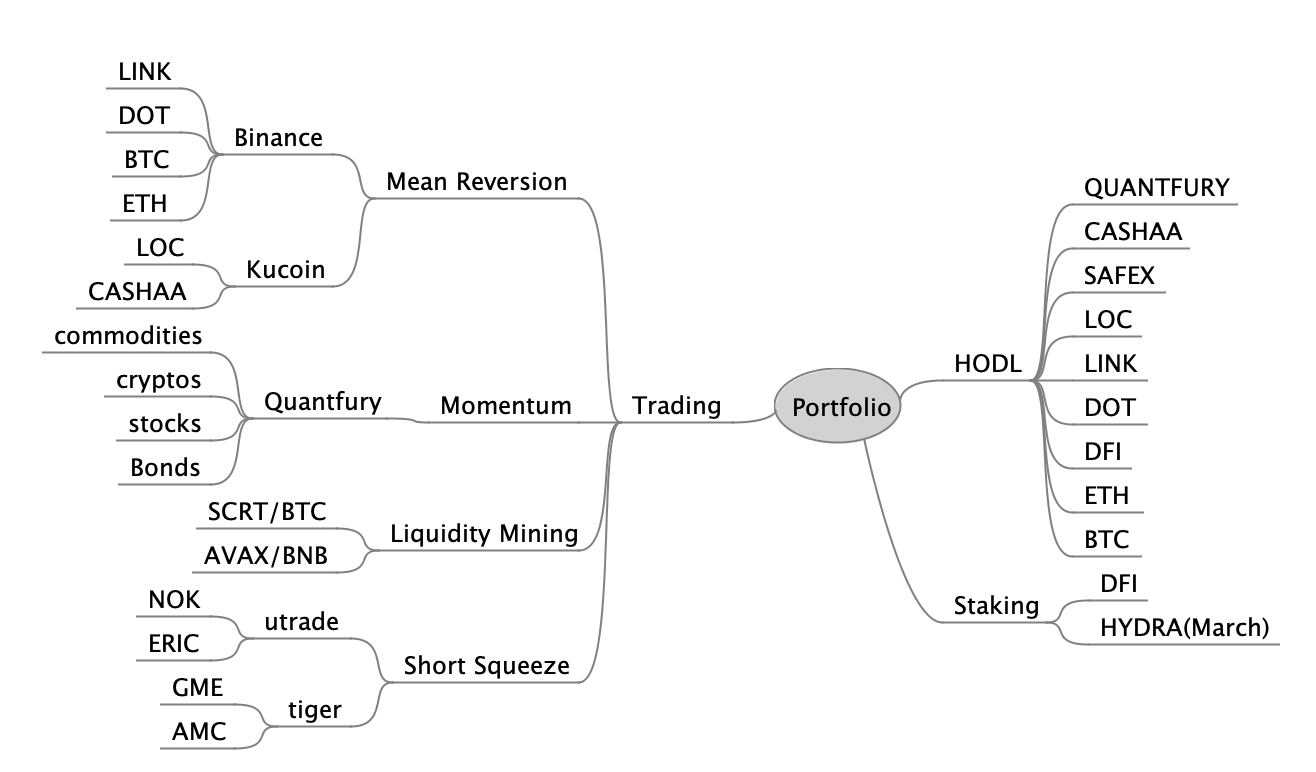

Was thinking to do a quarterly strategy but the events in the stock market have changed the dynamics a lot. See following mindmap.

Had move out of DFI cause they going to support Dodge as liquidity mining, I didn't like the coin even it has rallied a lot. Decided to move more into Cashaa since the next two-three months will be very interesting as they are moving rapidly into opening physical branches across India for Crypto banking services that are catered to retail folks. The market cap is pretty undervalued in India, see link. Have also decided to store up DOT for the long term.

Still waiting for Safex to be ready in BW to offload it, we'll see.

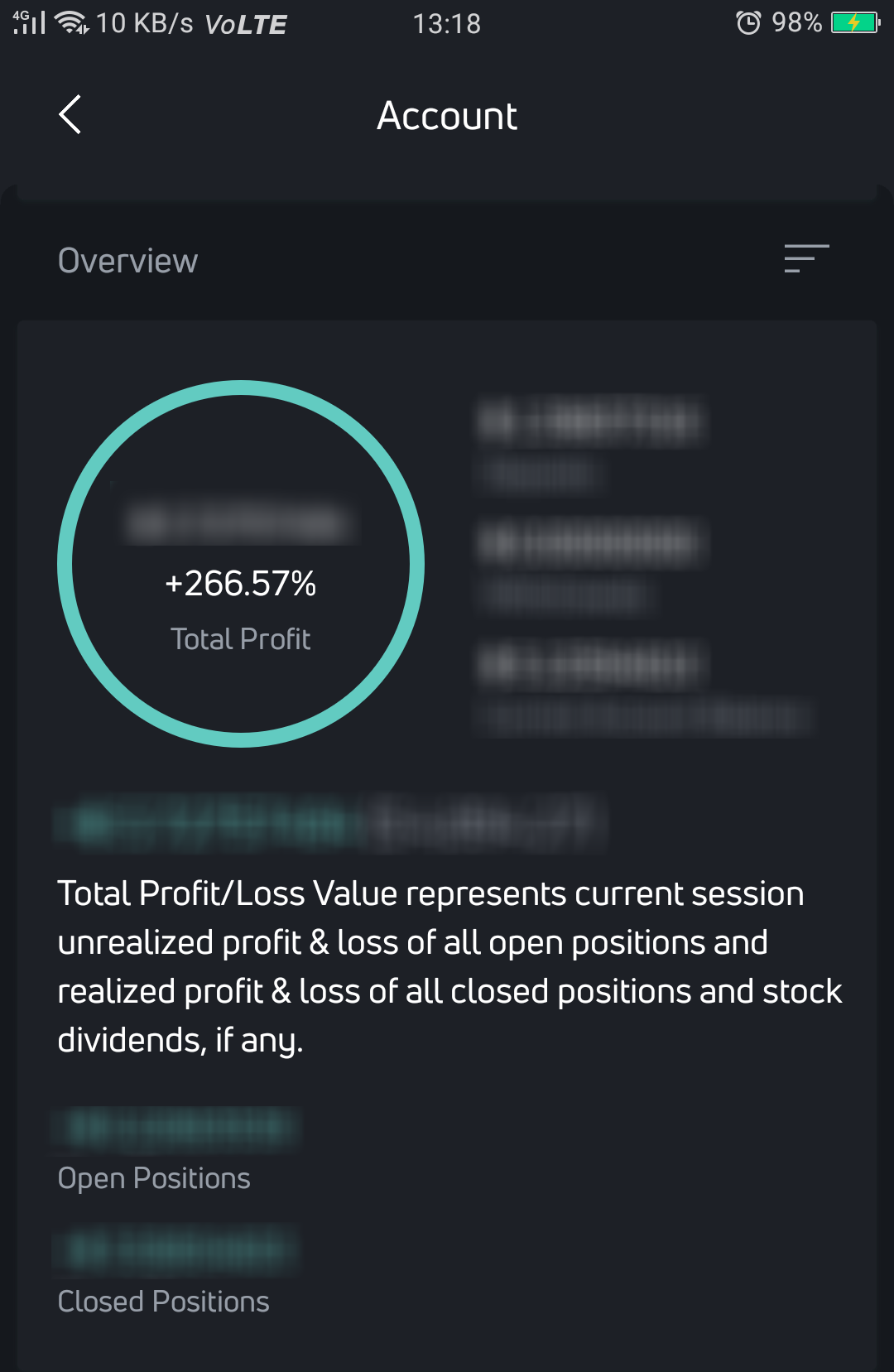

Now for the interesting part, short squeeze trade. Have loaded some funds in Tiger and Utrade, thinking whether to fade or join the movement, most likely in AMC and long TLT, GOLD for safety reasons but also looking for 5G stocks in the longer term. This is not about main street vs wall street, more about liquidity issues that might implode if WSB hold the line, an interesting nite. Depending on whats going to happen, will update again.