Long/Short Picks

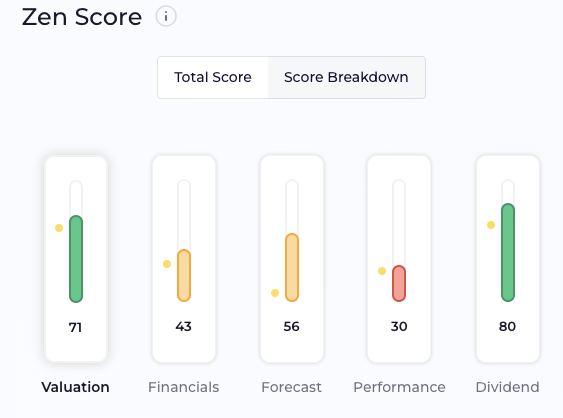

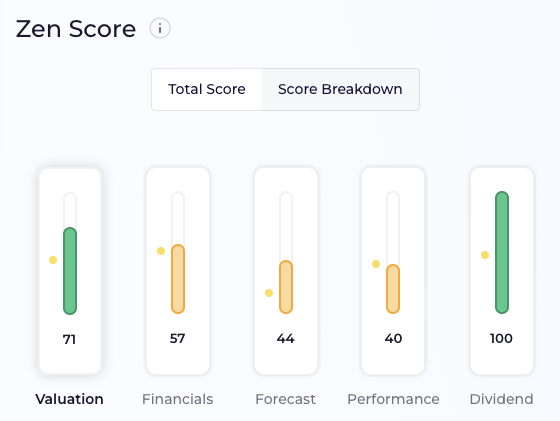

PBR - LONG/P1

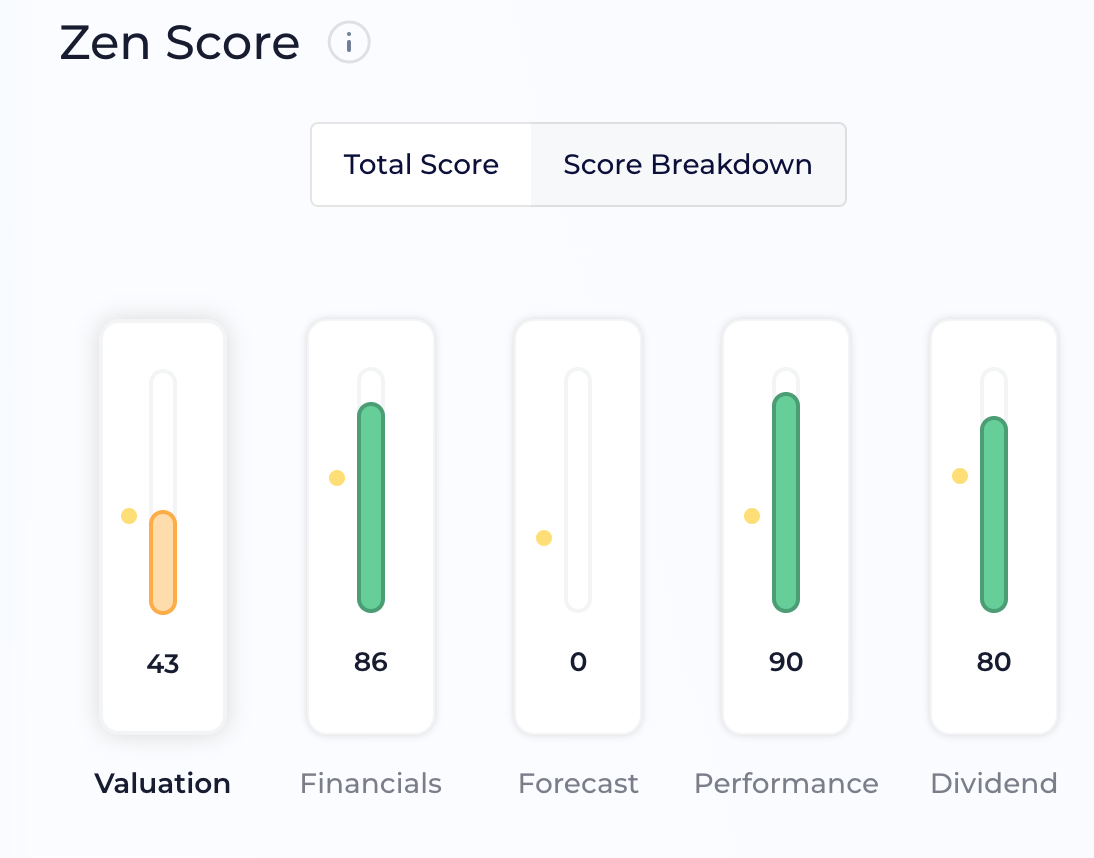

- TS: 71

- Earnings Report: 22 FEB 2023

- Options HL:

- Calls:10, OI:1484

- Puts:9.5, OI:893

CIB - LONG/P3

- TS: 56

- Earnings Report: 21 FEB 2023

- Options HL:

- Calls:30, OI:422

- Puts:25, OI:46

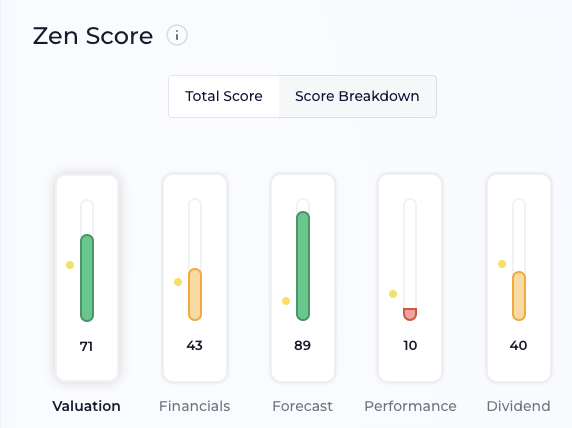

UPST - LONG/P1

- TS: 29

- Fair Price: 22.69

- Earnings Report: 21 FEB 2023

- Options HL: 17 FEB

- Calls:15, OI:13063

- Puts:15.5, OI:17290

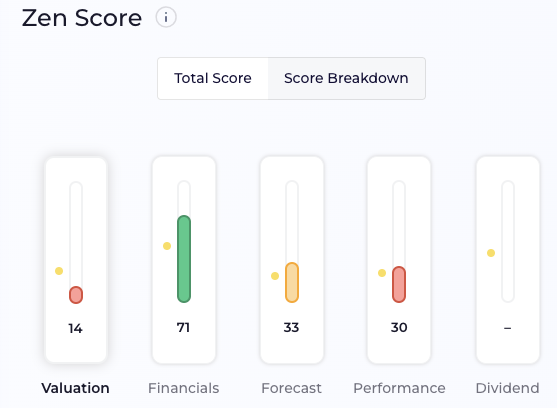

PLTR - Short

- TS: 28

- Fair Price: -

- Earnings Report: 15 FEB 2023

- Options HL: 17 FEB

- Calls:9, OI:21152

- Puts:5, OI:42941

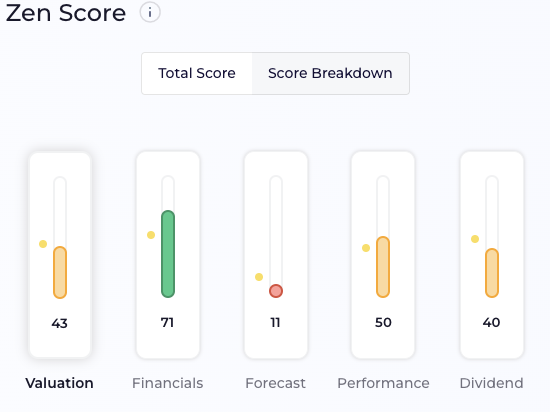

ESNT - HOLD

- TS: 43

- Fair Price: -

- Earnings Report: 10 FEB 2023

- Options HL: 17 FEB

- Calls:-, OI:-

- Puts:34, OI:47

Revisit after 20th jan options

NVAX - Long/P1

- TS: 23

- Fair Price: 28.22

- Earnings Report: 27 FEB 2023

- Options HL: 17 MAR

- Calls:40, OI:3210

- Puts:15, OI:2952

ZIM - Long/P3

- TS: 51

- Fair Price: 28.22

- Earnings Report: 20 MAR 2023

- Options HL: 21 APR

- Calls:25, OI:9486

- Puts:12.5, OI:18527

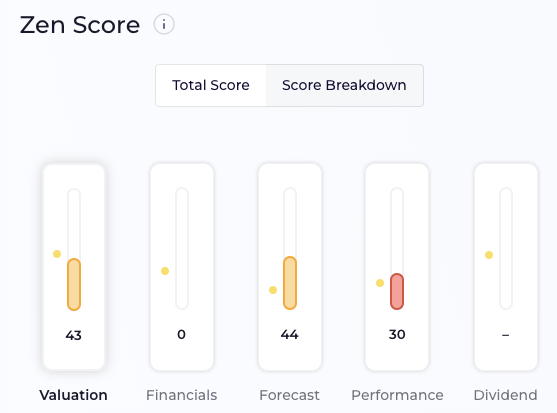

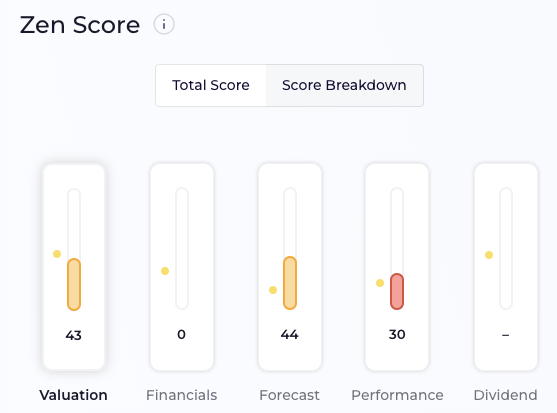

GOGL - Long/P3

- TS: 43

- Fair Price: 9.49

- Earnings Report: 28 FEB 2023

- Options HL: 21 APR

- Calls:10, OI:3351

- Puts:7.5, OI:4324

DAC - Long/P3

- TS: 63

- Fair Price: -

- Earnings Report: 13 FEB 2023

- Options HL: 21 APR

- Calls:55, OI:443

- Puts:55, OI:443

GT - SHORT

- TS: 38

- Fair Price: 16.08

- Earnings Report: 10 FEB 2023

- Options HL: 10 FEB

- Calls:12, OI:864

- Puts:8, OI:1267

BFH - LONG/P3

- TS: 39

- Fair Price: -

- Earnings Report: 26 JAN 2023

- Options HL: 20 JAN

- Calls:42.5, OI:336

- Puts:30, OI:1540

S - LONG/P3

- TS: 37

- Fair Price: -

- Earnings Report: 15 MAR 2023

- Options HL: 20 JAN

- Calls:15, OI:2526

- Puts:11, OI:1072

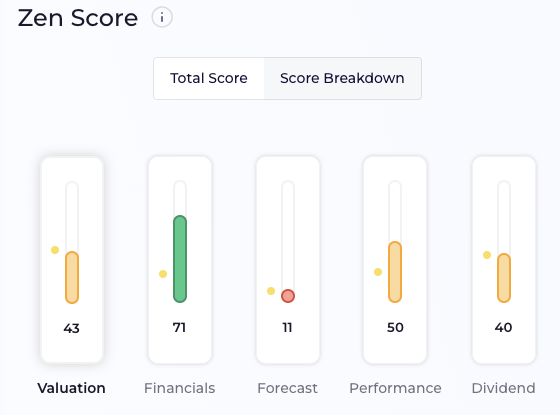

PATH - LONG

- TS: 32

- Fair Price: -

- Earnings Report: 30 MAR 2023

- Options HL: 19 MAY

- Calls:20, OI:5397

- Puts:12.5, OI:666

PFE - LONG

- TS: 60

- Fair Price: -

- Earnings Report: 31 JAN 2023

- Options HL: 03 FEB

- Calls:50, OI:1049

- Puts:49, OI:5533